Bitcoin Hits New All-Time High Above $124,000

- Slava Jefremov

- Aug 14, 2025

- 3 min read

Updated: Dec 9, 2025

Key Takeaways

Bitcoin price surges to new all-time high of $123,505, surpassing the prior peak just under $123,000.

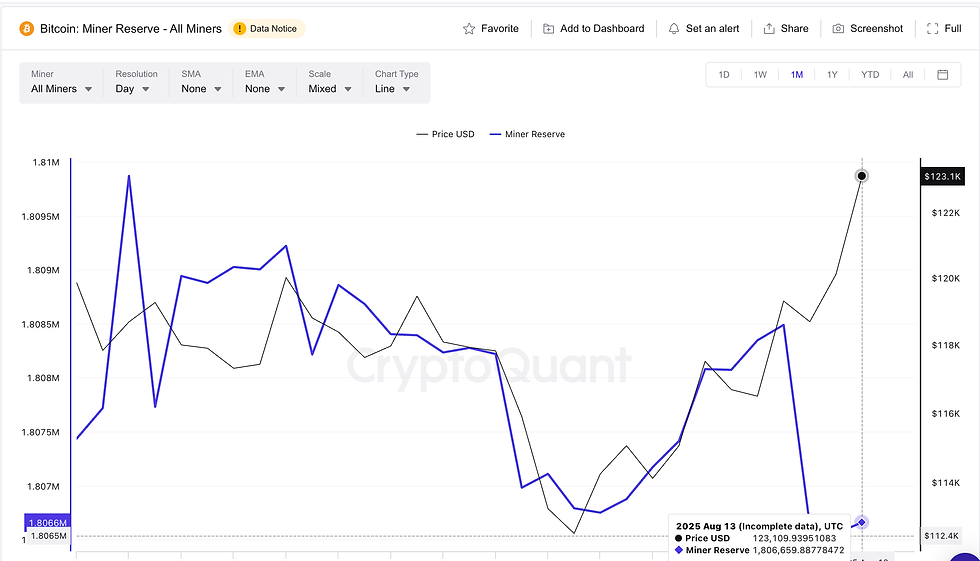

Miner reserves decline from 1,808,488 BTC to 1,806,630 BTC, reducing immediate selling pressure.

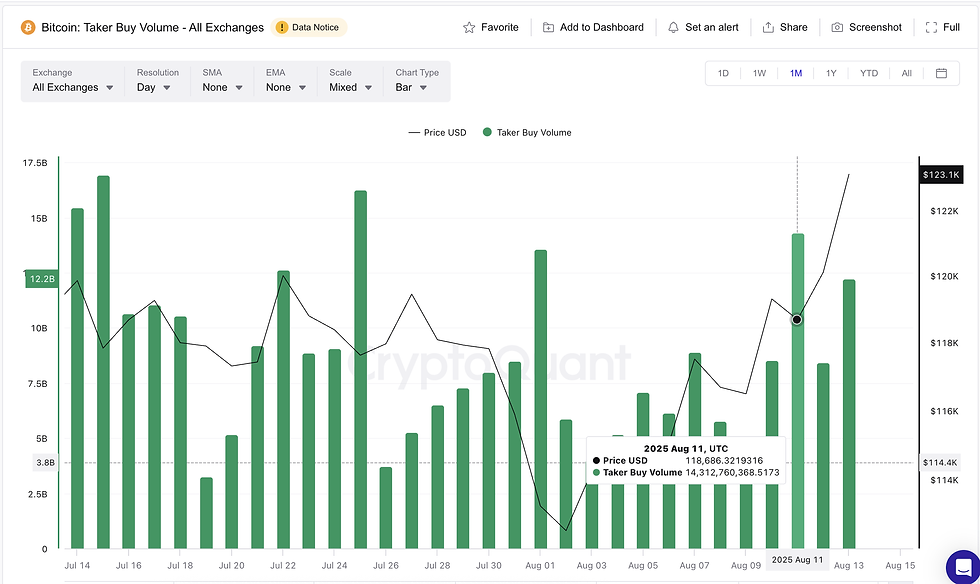

Taker Buy Volume remains robust at $12.24 billion, indicating persistent bullish momentum with eyes set on the $127,000 level.

Introduction

Bitcoin has officially entered uncharted territory, setting a fresh all-time high above $124,000. Over the past week, BTC has gained nearly 8%, riding a wave of intensified market optimism.

This milestone follows a notable alignment of on-chain signals that have tipped the scales in favor of the bulls. Aggressive buying pressure in perpetual futures has been brewing for several days, but this time, the rally is backed by an important shift in the supply-demand balance. With a key obstacle removed, market participants may now have their sights set even higher than the current record zone.

Miner Reserves Retreat, Easing Sell-Side Pressure

Earlier in August, miner reserves expanded from 1,806,790 BTC on August 2 to 1,808,488 BTC on August 10, raising the risk of a fresh supply influx into the market. Such an increase typically signals growing sell-side pressure from miners — a dynamic that can act as a headwind during bullish runs.

However, as Bitcoin began testing breakout levels, reserves reversed course, falling to 1,806,630 BTC and holding steady. This drop signals that the immediate selling threat from miners has diminished, effectively removing a significant layer of overhead supply.

This retreat in miner reserves creates a more favorable environment for buyers, offering a “clear runway” for upward momentum without the weight of large-scale miner liquidations.

Miner Reserves Explained

This metric tracks the total BTC held by miners. An increase often points to potential selling activity ahead, while a decrease typically reduces supply-side risk.

Taker Buy Volume Confirms Buyer Aggression

On August 11, Taker Buy Volume — the notional value of market buy orders removing sell-side liquidity — spiked to $14.31 billion during a breakout attempt that ultimately failed.

The mechanics are important: for a market buy order to execute, it must “hit” existing sell orders in the order book. This means buyers are accepting the seller’s price immediately rather than waiting for a dip, indicating urgency and conviction.

High Taker Buy Volume, therefore, reflects aggressive demand — buyers actively clearing out sell orders, which can accelerate upward price movement when sustained.

Even after the initial attempt stalled, this metric has remained elevated at $12.24 billion, showing traders are still chasing price higher rather than passively waiting for lower entry points.

Historically, such persistent buy-side aggression often precedes successful breakouts, suggesting that the recent surge was less a question of if and more a matter of when.

Key Bitcoin Price Levels to Watch

With momentum heavily favoring the bulls, the immediate resistance lies at $124,300, representing the final major hurdle before higher targets come into focus.

A decisive break and daily close above this level could pave the way for $127,600, which aligns with the 1.0 Fibonacci extension — marking the next major upside milestone.

Conversely, if BTC slips below $121,600, particularly alongside a rebound in miner reserves, the bullish setup could be challenged, potentially triggering a deeper correction.

Conclusion

Bitcoin’s latest rally into all-time high territory is not just a product of market excitement — it’s underpinned by meaningful shifts in on-chain dynamics. A decline in miner reserves has eased supply pressure, while sustained high Taker Buy Volume shows that buyers remain aggressive and committed. If BTC can break and hold above $124,300, the path toward $127,600 becomes increasingly likely. Still, traders should remain cautious of a potential reversal if key support levels fail.

Frequently Asked Questions

What does a drop in miner reserves mean for Bitcoin’s price?

A decline in miner reserves suggests that miners are selling less BTC into the market, reducing immediate supply pressure. This often supports upward price momentum.

Why is Taker Buy Volume important?

Taker Buy Volume measures the value of market buy orders that remove existing sell orders from the order book. High readings indicate aggressive buying, which can drive prices higher if sustained.

What are the critical price levels for BTC right now?

The key resistance is $124,300, while major support lies at $121,600. A break above resistance could open the path toward $127,600, whereas a drop below support may trigger a sharper pullback.

How does the Fibonacci extension influence Bitcoin targets?

The 1.0 Fibonacci extension is a technical projection tool that traders use to identify possible price targets after a breakout. In this case, it points toward $127,600 as a likely next upside goal.

Is this rally sustainable?

While bullish momentum remains strong, sustainability will depend on whether buy-side pressure continues and supply from miners stays limited. Price action around $124,300 will be a key test.

Comments