Bitcoin at $122K: US Economic Signals That Could Shape Its Next Move

- Slava Jefremov

- Aug 11, 2025

- 4 min read

Updated: Dec 11, 2025

Introduction

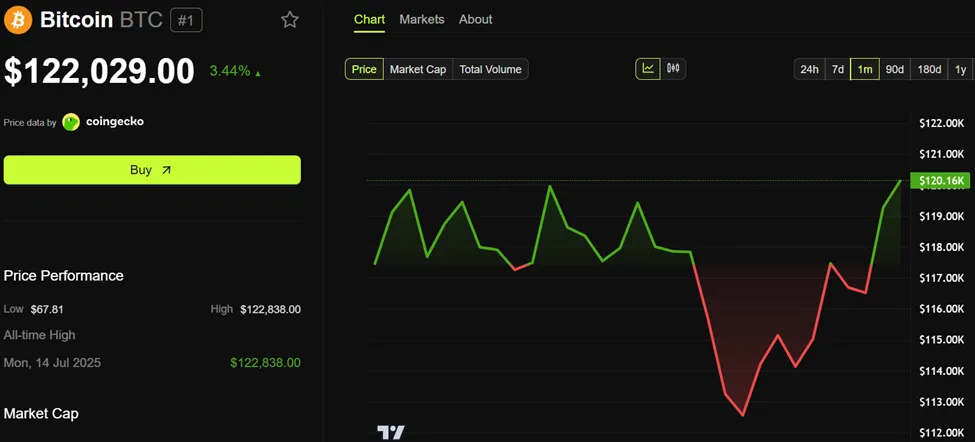

Bitcoin (BTC) is once again testing its recent highs, surging above the $122,000 mark. But whether this rally sticks depends on several critical Bitcoin US economic signals releases scheduled for this week.

With institutional investors now holding a significant share of BTC alongside retail participants, macroeconomic signals from the US have become increasingly important in determining the cryptocurrency’s direction.

Key Takeaways

US economic indicators such as CPI, PPI, retail sales, and jobless claims are key drivers for Bitcoin’s short-term price trajectory.

A hotter-than-expected CPI could strengthen the dollar and pressure Bitcoin downward, while a softer print might ignite a crypto rally.

Stable or rising jobless claims could reinforce Fed rate-cut expectations, supporting Bitcoin’s momentum.

Major US Economic Signals to Watch This Week

Consumer Price Index (CPI)

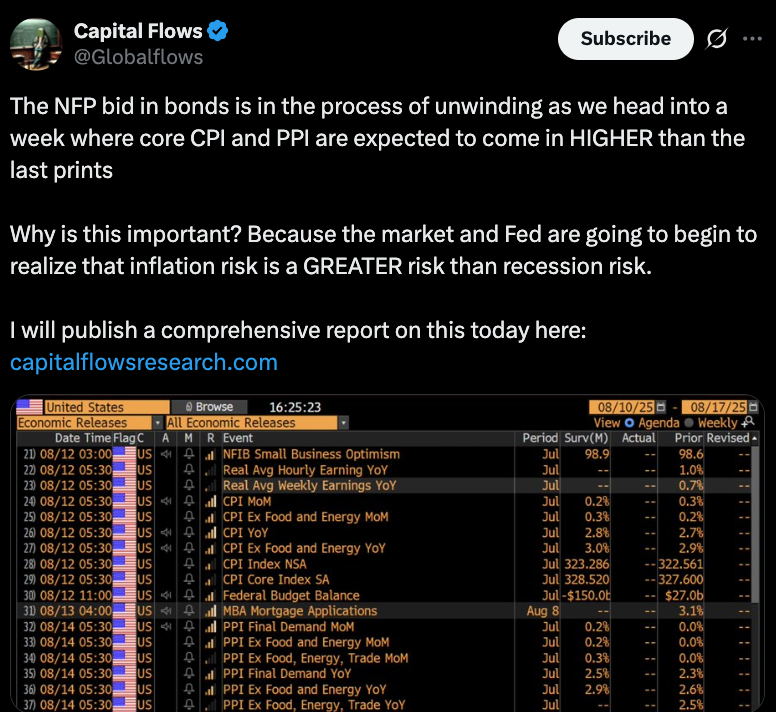

The Consumer Price Index (CPI), arguably the most pivotal US economic metric this week, is set for release on Tuesday, August 12. CPI is a key driver of Federal Reserve interest rate expectations.

Economists expect a 2.8% year-over-year (YoY) increase in July—slightly higher than the 2.7% recorded in June—a projection echoed by Goldman Sachs. This comes in the wake of Trump’s tariffs, which took effect on August 7 and are anticipated to add upward pressure to inflation.

“CPI Inflation data hits Tuesday! Economists’ consensus is that tariffs drove July’s CPI higher,” wrote Peter Tarr, private investment manager.

A reading above 2.8% could strengthen the US dollar, placing downward pressure on Bitcoin. Conversely, a print below 2.7% might trigger a crypto rally.

“After recent unemployment data, the September rate cut probability is at 91%. If CPI comes in lower than expected, the September rate cut will be confirmed. This will help risk-on assets rally even more… Given that the unemployment rate has been going up lately, CPI is expected to come lower, which will be good for the markets,” noted BitBull.

Still, Tarr warns that the impact might be muted:

“Economists have done a pretty poor job thus far and the expectations of a slightly higher print are already baked in. It’s nuanced,” he said.

Producer Price Index (PPI)

Scheduled for Thursday, the Producer Price Index (PPI) is another vital inflation gauge. PPI measures wholesale prices and often acts as a leading indicator for consumer inflation trends. Persistent inflation at the producer level can keep the Fed in a tighter policy stance, restricting liquidity in markets—something that affects Bitcoin and other risk assets. Economists expect PPI to tick higher compared to June’s 2.3% reading.

Just like CPI, a surprise increase in PPI could heighten inflation concerns, influencing both rate expectations and crypto sentiment.

Retail Sales

The US Census Bureau will release July retail sales data on Friday, August 15. This metric is critical, as consumer spending drives around 70% of US GDP.

Economists expect a 0.5% increase, down slightly from June’s 0.6% reading. While such a dip would suggest mild cooling, it would still point to a strong consumer sector.

Beating expectations could reinforce a “strong economy” narrative, lifting yields and the dollar—both potential short-term headwinds for Bitcoin. Missing expectations, however, could push the Fed toward a more dovish stance, potentially boosting BTC.

Initial Jobless Claims

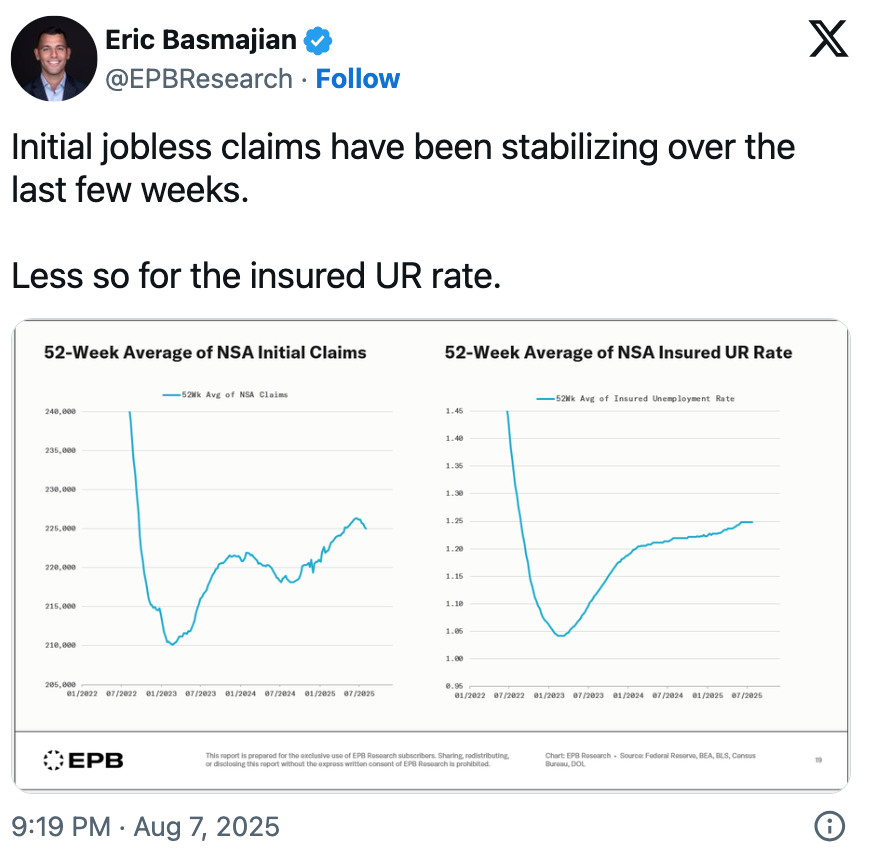

Labor market data has become increasingly relevant to crypto traders. Initial jobless claims, which track new unemployment benefit filings, came in at 226,000 for the week ending August 2. Continuing claims rose by 38,000 to 1.97 million, the highest since November 2021.

For last week, economists forecast 229,000 claims. Analysts note that claims have stabilized, hinting at a cooling—though not collapsing—labor market.

A stable or slightly rising trend could encourage Fed rate-cut bets, supporting Bitcoin’s momentum in the short term.

Bitcoin’s Current Position

At the time of writing, BTC trades at $122,029, up 3.44% in the last 24 hours. The coming days’ data could determine whether it continues higher, or faces resistance.

Conclusion

This week’s US economic calendar is stacked with high-impact data points that could sway Bitcoin’s trajectory. CPI and PPI readings will set the tone for inflation expectations, retail sales will shed light on consumer resilience, and jobless claims will gauge labor market strength.

In an environment where institutional capital increasingly drives BTC’s movements, macroeconomic signals carry more weight than ever. A dovish tilt from the Fed, sparked by weaker-than-expected inflation or labor market data, could propel Bitcoin higher. Conversely, signs of stubborn inflation or stronger-than-expected economic resilience could give the dollar a boost—posing challenges for BTC’s rally.

FAQ

Why does the CPI matter for Bitcoin?

Because CPI influences Fed interest rate policy. Higher inflation readings could delay rate cuts, strengthening the dollar and pressuring Bitcoin. Lower readings could do the opposite.

How does PPI affect crypto markets?

PPI measures producer-level inflation. If it rises significantly, markets may expect more hawkish Fed policy, which can reduce liquidity for risk assets like Bitcoin.

Are retail sales really that important?

Yes. Consumer spending makes up roughly 70% of US GDP, so stronger-than-expected retail sales suggest a robust economy, which can influence yields, the dollar, and indirectly, Bitcoin.

What’s the link between jobless claims and Bitcoin?

Higher jobless claims may signal a cooling labor market, increasing the chances of Fed rate cuts—which tend to be bullish for Bitcoin.

What’s Bitcoin’s short-term outlook based on these indicators?

If inflation readings come in soft and jobless claims trend higher, Bitcoin could extend its rally past $122K. Stronger-than-expected data might trigger short-term selling pressure.

Comments