Bitcoin's Supply: Why 21 Million Isn't the Whole Story

- Slava Jefremov

- Dec 25, 2025

- 10 min read

Introduction

Bitcoin's 21 million coin cap represents the protocol's hard-coded issuance limit, enforced through a block subsidy that halves every 210,000 blocks. However, this headline figure masks a crucial economic reality: the number of bitcoins actually usable or spendable in the market is meaningfully lower than the number most supply dashboards display. Understanding the gap between theoretical supply and real supply is essential for anyone investing in or mining Bitcoin.

Key Takeaways

Bitcoin's 21 million cap reflects the issuance schedule, not how much BTC is actually usable or accessible to holders and traders.

A significant portion of the supply remains locked away through unmined coins, provably unspendable outputs created by design, and millions of bitcoins lost permanently due to forgotten private keys and custody failures.

Major researchers estimate between 2.3 and 4 million BTC are effectively removed from circulation, even under conservative assumptions, representing 11 to 18 percent of the maximum supply.

The economic reality of Bitcoin's supply is best understood as the 21 million headline cap minus future issuance that hasn't occurred yet, minus unspendable coins created by protocol features, and minus lost or inaccessible bitcoins that can never move again.

This distinction between theoretical and real supply has profound implications for scarcity, institutional adoption, and long-term value dynamics in Bitcoin markets.

How Bitcoin's Issuance Schedule Creates an Asymptote, Not a Hard Line

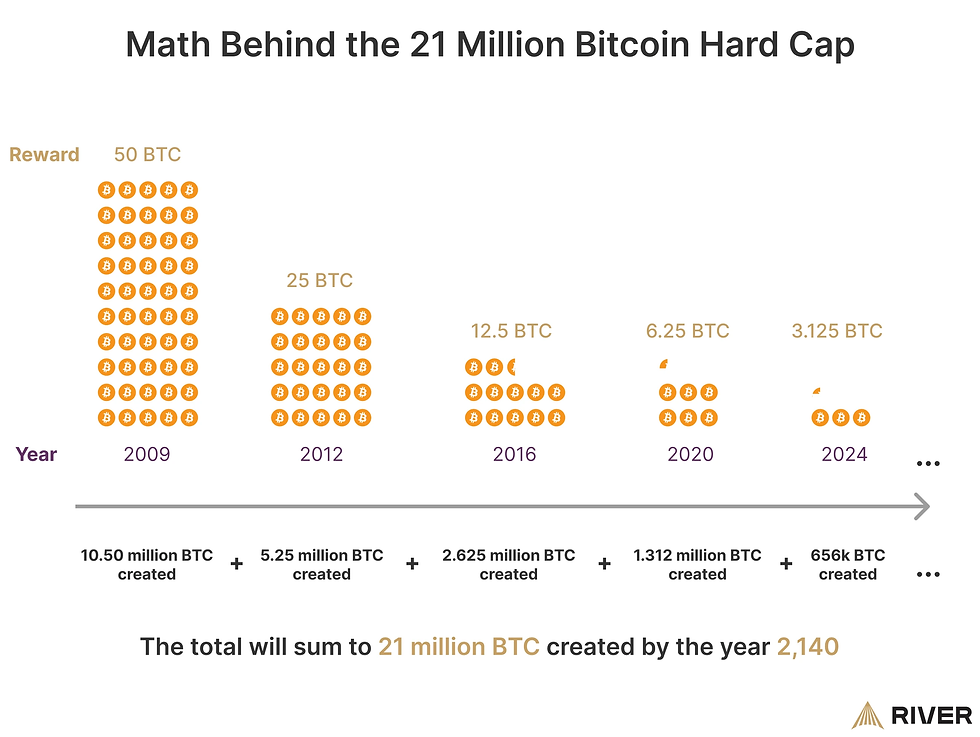

Bitcoin's 21 million cap emerges from the block subsidy function that began at 50 bitcoins per block and cuts in half every 210,000 blocks. This halving schedule is embedded directly into Bitcoin Core and represents the mechanical foundation for why people refer to Bitcoin's 21 million limit. The system appears simple on the surface, but practical details complicate the exact final number.

Halvings occur every 210,000 blocks rather than on a fixed calendar date, which means the exact timing drifts as block production varies. Additionally, because the subsidy is denominated in satoshis—the smallest unit of bitcoin—and repeatedly halved using integer arithmetic until it truncates to zero, the final issued amount lands slightly below 21,000,000 BTC. Technical analyses often cite the maximum issuance at approximately 20,999,999.9769 BTC rather than an exact 21 million.

This mathematical quirk matters because it demonstrates that Bitcoin's supply cap functions as an asymptote that the system approaches but never quite reaches. The difference is trivial in percentage terms, but it highlights that even the theoretical maximum is better described as "about 21 million" rather than a guaranteed exact integer. For practical purposes, investors and miners should think of Bitcoin's maximum possible supply as a ceiling that is never quite touched, not a figure ever perfectly achieved.

Unmined Coins Represent a Substantial Portion of the 21 Million Cap

Bitcoin's circulating supply—typically defined as coins already mined to date—remains substantially below the 21 million maximum. As of late 2025, approximately 19.8 to 19.96 million bitcoins have been mined, representing roughly 95 percent of the total cap. This straightforward arithmetic means that nearly 1.2 million bitcoins remain scheduled for future issuance through ongoing mining rewards that will continue through roughly 2140.

Blockchain explorers and supply trackers like Blockchain.com and CoinMarketCap report circulating supply by tracking how much bitcoin has been issued so far, not how much is accessible or liquid in markets. This distinction matters significantly because "in circulation" technically means "created," not "accessible or tradeable." The remaining unmined supply will emerge through future block rewards, with the rate declining at each halving event.

Currently, miners add approximately 3.125 bitcoins per block, or about 450 bitcoins daily following the 2024 halving, translating to roughly 164,000 bitcoins per year. By 2028, this annual issuance will drop further to approximately 82,000 bitcoins per year as the next halving reduces block rewards again. The fact that future supply remains locked in the mining schedule means Bitcoin's true economic scarcity increases with each passing day, as fewer new coins enter the market while lost coins accumulate.

Some Bitcoin Is Provably Unspendable by Protocol Design

Not all bitcoins that exist on the blockchain can theoretically be spent, even if someone had access to wallets or addresses holding them. The protocol itself contains mechanisms that create permanently unspendable outputs, removing those coins from any meaningful economic circulation.

The genesis block's subsidy represents the first example. Bitcoin's first block includes a subsidy output that cannot be spent under Bitcoin's rules and implementation, and this unspendable coin is widely treated by the network as permanently locked away. This is not a technical glitch or an oversight—it is an accepted part of Bitcoin's initial state.

The OP_RETURN opcode provides a second, intentional mechanism for creating provably unspendable outputs. This special script command allows developers and users to embed arbitrary data into Bitcoin transactions while simultaneously marking the associated satoshis as unspendable and unrecoverable. When OP_RETURN executes during transaction validation, it terminates the script and ensures the associated output cannot be spent, effectively burning any bitcoins assigned to it. The feature is standardized and widely documented in Bitcoin's developer guidance as a tool for proof of existence, data anchoring, and other uses that require permanent record-keeping without actual economic value transfer.

An important distinction exists between provably unspendable outputs and practically inaccessible coins. When someone discards a private key, the associated bitcoins become practically unspendable, but it is not cryptographically obvious to the network in the way an OP_RETURN output is. This nuance means that some coin losses are provable through protocol analysis, while others can only be estimated through statistical methods examining on-chain behavior patterns.

Lost Coins Represent the Largest Supply Reduction

The most significant factor reducing Bitcoin's real usable supply comes from coins that are likely lost or permanently inaccessible due to custody failures. Bitcoin's design creates an asymmetry: if you lose your private keys, no central authority exists to reset them and restore access. This fundamental property has resulted in millions of bitcoins becoming permanently inaccessible over the network's history.

Measuring what counts as "lost" presents a methodological challenge since on-chain inactivity does not definitively prove loss. A dormant address might represent long-term hodling, institutional cold storage, or simply an early adopter who exited the market—not necessarily lost keys. Credible estimates therefore emerge as ranges derived from heuristics examining wallet behavior, address dormancy patterns, and documented loss events rather than definitive counts.

Chainalysis published research in 2018 estimating that between 2.3 million and 3.7 million bitcoins had been lost, examining supply data to understand Bitcoin's effective money supply. River Financial provided a 2023 estimate suggesting that 3 million to 4 million bitcoins are "irreversibly lost," framing this as a material share of total supply concentrated in long-dormant addresses that haven't moved coins in over a decade. CoinShares estimated approximately 1.58 million bitcoins could be classified as lost as of March 2025, though more recent research suggests the figure is higher.

The most sobering observation comes from examining loss rates relative to new issuance. Recent analysis indicates that 566 bitcoins daily are aging into the "ancient" category—coins unmoved for over ten years—compared to only 450 bitcoins mined daily following the 2024 halving. This means the rate of coins aging into suspected-lost status exceeds the rate of new supply entering the market. If just 0.5 percent of current holders lose access annually, approximately 95,000 bitcoins could vanish yearly, exceeding post-2028 annual issuance of 82,000 bitcoins. At a 1 percent annual loss rate, this figure doubles to 190,000 bitcoins, more than double Bitcoin's projected yearly production by 2028.

Circulating Supply Dashboards Are Accurate, But They Measure the Wrong Thing

CoinMarketCap defines "circulating supply" as the best approximation of assets available to the public, typically reported as the number of coins mined to date. This definition remains technically accurate and useful for tracking issuance progress, but it does not claim that all reported coins are liquid, accessible, or capable of being sold or moved without friction. Understanding this distinction prevents misinterpretation of supply metrics.

Circulating supply dashboards do not assert that all coins are freely tradeable in markets, nor do they account for the behavioral and technical factors that remove coins from meaningful economic circulation. Two statements can simultaneously be true: 19.8 million bitcoins exist because they have been mined, and the truly spendable or accessible supply is materially lower due to provably burned coins and likely lost bitcoins. The dashboards are not misleading—they simply measure technical issuance data, not market liquidity.

For investors evaluating Bitcoin's supply narrative, this means that prominent supply figures should be interpreted as baseline issuance metrics, not as direct measures of how many coins are actually available to buy or sell in markets. The real supply available for trading, holding, and spending is significantly constrained by protocol burns, custody losses, and the normal human failures that accompany self-custody of valuable assets.

What Bitcoin's Real Supply Means for Investors

For investors analyzing Bitcoin as a store of value, the structural reality of lower effective supply reinforces a critical property: Bitcoin's scarcity is ultimately determined by accessible coins, not theoretical issuance limits. The protocol enforces a hard ceiling on creation, but a meaningful portion of issued bitcoins is permanently removed from economic circulation through provable burns and lost private keys. This creates a natural deflationary dynamic where the number of bitcoins that can realistically be held, transferred, or sold is measurably smaller than commonly cited supply figures suggest.

The implication is straightforward but profound. As new issuance slows through successive halvings while loss rates potentially accelerate, Bitcoin becomes progressively scarcer in real terms. An investor who secures their private keys effectively holds a larger claim on the available supply that remains liquid compared to previous holders at earlier prices. The supply constraints become tighter over time, not looser, assuming custody losses continue at historical rates or increase modestly.

This scarcity dynamic also raises the stakes for institutional adoption. Unlike traditional assets where supply expansion can be managed by central authorities through policy changes, Bitcoin's supply trajectory is entirely predefined and immutable. Institutions adopting Bitcoin implicitly accept that new supply will decline predictably and that a material fraction of existing supply will gradually age out of circulation. This creates unprecedented clarity around long-term scarcity relative to other assets.

What Bitcoin's Real Supply Means for Miners

For miners, the fact that Bitcoin's effective supply is lower than 21 million bitcoins does not alter the fundamental economics of mining or the protocol's consensus rules. Block rewards, halving mechanics, and issuance schedules remain unchanged regardless of how many older bitcoins are lost to custody failures. The protocol continues issuing new bitcoins according to the predefined subsidy schedule, and that schedule has no mechanism to compensate miners for lost coins in circulation.

However, an understanding of effective supply still carries indirect relevance for mining operations. Newly mined bitcoins are fully usable and immediately spendable, making miners the primary source of new, liquid bitcoins entering the market. This gives miners a strategic advantage as the sole source of virgin supply in a system where older supply is increasingly inaccessible. As loss rates outpace issuance, mining-fresh bitcoins command premium liquidity characteristics compared to older holdings.

Halvings remain the dominant mechanism controlling supply velocity, not lost coins. While reduced usable supply does contribute to long-term deflation, successive halving events remain the primary tool slowing new bitcoin issuance. A miner's economics do not change based on how many bitcoins were lost in 2011 or 2012—what matters is the block reward they receive today and the market value of that reward relative to their operational costs.

Conclusion

Bitcoin's 21 million coin cap represents a genuine hard limit on total possible issuance, but it is not the same as the supply available for actual economic use. The real usable supply is substantially lower once accounting for coins still scheduled for future mining, outputs designed to be unspendable, and millions of bitcoins lost to forgotten keys and catastrophic custody failures. Research from leading blockchain analytics firms suggests the effective circulating supply is between 15.8 and 17.5 million bitcoins, with loss rates now exceeding new issuance rates as successive halvings reduce block rewards.

This distinction between headline supply and real supply is not obscure technical trivia, it directly impacts how investors should evaluate Bitcoin's scarcity narrative and how miners should understand their position as the sole source of new liquid supply. The economic reality is that Bitcoin becomes progressively scarcer over time as new issuance declines and lost coins accumulate. Understanding this dynamic is essential for anyone making serious decisions about Bitcoin exposure or mining operations.

Fast Facts

Between 2.3 and 4 million bitcoins, representing 11 to 18 percent of the maximum 21 million cap, are estimated to be permanently lost due to forgotten private keys and hardware failures.

The effective circulating supply of Bitcoin is approximately 15.8 to 17.5 million coins, down from the 19.8 million that have been mined, after accounting for lost and unspendable coins.

As of late 2025, 566 bitcoins daily are aging into the "ancient" category (unmoved for over ten years), exceeding the 450 bitcoins mined daily following the 2024 halving.

If holders lose access to just 0.5 percent of Bitcoin annually, approximately 95,000 bitcoins would vanish yearly by 2028, surpassing the projected annual issuance of 82,000 bitcoins.

OP_RETURN is a protocol feature that allows users to create provably unspendable outputs, effectively burning bitcoins permanently while embedding data on the blockchain.

Frequently Asked Questions

What is the difference between Bitcoin's maximum supply and circulating supply?

Bitcoin's maximum supply is the theoretical cap of 21 million bitcoins that can ever be created through mining. Circulating supply refers to bitcoins that have already been mined—currently about 19.8 million. However, not all circulating supply is accessible; much is lost to forgotten keys or intentionally burned, making the true usable supply significantly lower than reported circulating figures.

How many bitcoins are actually lost forever?

Research estimates between 2.3 and 4 million bitcoins are permanently lost, representing 11 to 18 percent of the maximum supply. This includes coins lost to forgotten private keys, discarded hardware wallets, and early adopters who died without passing on access credentials. The exact number cannot be proven on-chain since dormancy doesn't prove loss, only suggest it.

Why does Bitcoin's supply matter for investors?

Bitcoin's real supply matters because it determines actual scarcity independent of the headline 21 million figure. As new issuance slows with each halving and loss rates outpace production, bitcoins become progressively scarcer. Investors should understand that the supply available for actual trade or holding is significantly constrained compared to widely reported metrics.

Can Bitcoin's 21 million cap ever be changed?

No, Bitcoin's 21 million cap is embedded in the protocol and cannot be changed without a hard fork that would split the network. Such a change would require consensus from miners, nodes, and users—a threshold that is economically and technically infeasible given the vested interests in Bitcoin's fixed supply promise.

What is OP_RETURN and how does it burn bitcoins?

OP_RETURN is a Bitcoin script opcode that creates provably unspendable transaction outputs, effectively burning any bitcoins assigned to them. Users and developers employ OP_RETURN to embed data on the blockchain—such as cryptographic proofs or digital records—while making the associated bitcoins irrecoverable. It is a standardized, intentional burning mechanism built into Bitcoin's protocol.

Comments