WLFI Explained: Identifying the Real Token and Dodging Scammers

- Slava Jefremov

- Sep 2, 2025

- 3 min read

Updated: Dec 8, 2025

Introduction

After months of anticipation, the Donald Trump–backed World Liberty Financial (WLFI) token officially began trading Monday morning. Despite the highly publicized launch, confusion persists regarding WLFI’s unlock schedule, its supported exchanges, and most importantly, how to distinguish the legitimate token from a wave of imitations flooding the market.

Key Takeaways

WLFI is the governance token of World Liberty Financial, launched in 2024 with a total supply of 24.66 billion tokens.

Token allocation includes 10B to World Liberty Financial Inc., 7.78B to Alt5 Sigma, 2.88B to liquidity/marketing, and 4B+ to the public.

WLFI trading is supported on Binance, Bybit, Bitget, KuCoin, and soon Coinbase.

Scammers are circulating fake WLFI tokens, so investors must use the official contract addresses.

At launch, WLFI hit a $6.4B market cap, with prices rising 14% to $0.26, though volatility remains high.

What is WLFI?

WLFI serves as the native token of World Liberty Financial, a decentralized finance (DeFi) platform founded in 2024. While the project has kept its exact use cases somewhat vague, WLFI is positioned as a bridge between traditional finance and decentralized protocols. Functioning as the ecosystem’s governance token, WLFI grants holders voting rights over major protocols, strategic partnerships, and platform development.

On Monday, the project confirmed WLFI’s official launch with a total supply of 24.66 billion tokens, allocated as follows:

10 billion tokens to World Liberty Financial Inc.

7.78 billion tokens to enterprise blockchain company Alt5 Sigma Corporation

2.88 billion tokens dedicated to liquidity and marketing

Just over 4 billion tokens made available to the public

Which Exchanges Support WLFI at Launch?

WLFI received immediate support from several major exchanges:

Binance became the first major platform to list WLFI, launching pairs against USDC and USDT.

Bybit, Bitget, and KuCoin also enabled WLFI trading.

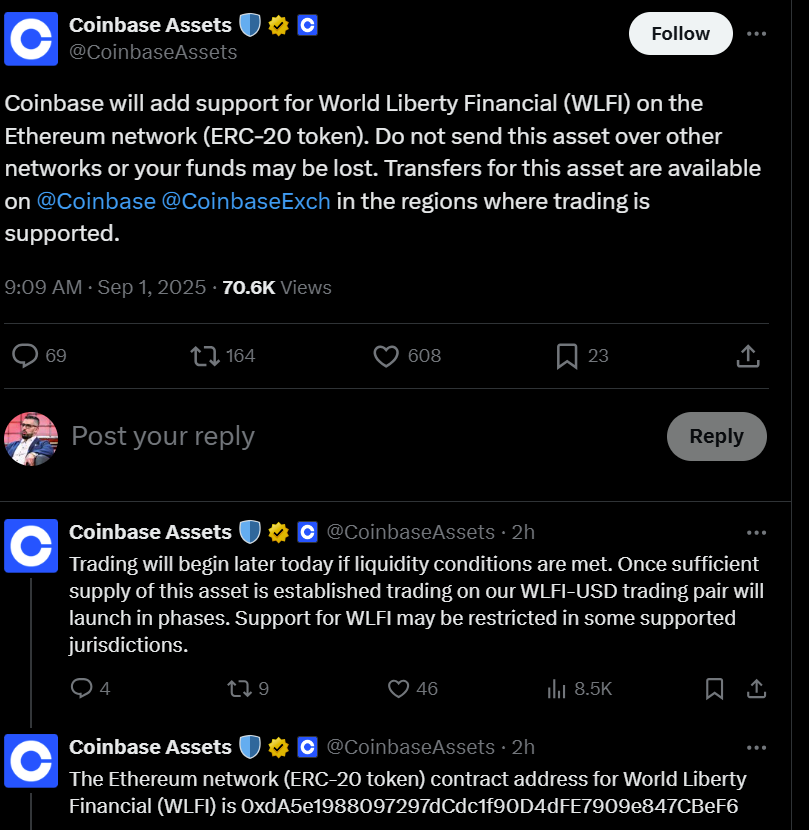

Coinbase confirmed support on the Ethereum network, though trading will only go live once “sufficient liquidity conditions are met.”

The quick exchange adoption signals high demand but also underscores the importance of using verified platforms to avoid counterfeits.

How to Avoid WLFI Scams

As hype surrounding WLFI spread, numerous fraudulent versions of the token appeared. Analytics firm Bubblemaps identified a surge of “bundled clones” — imitation smart contracts designed to trick traders into buying fake assets. Sending funds to the wrong contract address could mean an irreversible loss.

The official WLFI smart contract addresses are:

Ethereum: 0xdA5e1988097297dCdc1f90D4dFE7909e847CBeF6

BNB Smart Chain: 0x47474747477b199288bF72a1D702f7Fe0Fb1DEeA

Solana: WLFinEv6ypjkczcS83FZqFpgFZYwQXutRbxGe7oC16g

Investors should also exercise caution on social media. Many crypto scams originate on X, with fake accounts imitating official sources. WLFI has confirmed that verified updates will only come from its official @worldlibertyfi handle.

Post-Launch Market Volatility

WLFI’s debut drew significant attention across the crypto community. With its circulating supply of 24.66 billion tokens, the token launched at a market capitalization of $6.4 billion, according to CoinMarketCap. Trading volumes surged on launch day, pushing WLFI’s price up 14% to $0.26.

As with many new tokens, WLFI’s early trading has been defined by a combination of speculative demand, limited liquidity, and uncertainty surrounding long-term adoption. These factors create the conditions for sharp volatility, making WLFI’s short-term price trajectory difficult to predict.

Conclusion

WLFI’s launch has ignited significant interest, fueled in part by its association with Donald Trump and its promise of bridging DeFi with traditional finance. However, the token’s vague utility, rapid speculation, and flood of scams make it a risky landscape for investors.

Verifying official contract addresses and relying only on trusted exchange listings are essential steps for avoiding fraud. As WLFI continues to mature, its long-term success will depend on whether it can move beyond speculation and deliver meaningful real-world use cases.

Frequently Asked Questions

What is WLFI’s primary purpose?

WLFI functions as a governance token, granting holders voting power over World Liberty Financial’s protocols, partnerships, and platform decisions.

How many WLFI tokens are in circulation?

WLFI launched with a total supply of 24.66 billion tokens, distributed among the founding company, strategic partners, liquidity, and the public.

Where can I buy WLFI safely?

WLFI is listed on Binance, Bybit, Bitget, and KuCoin, with Coinbase support pending. Always confirm the exchange is using the official contract addresses.

How can I avoid WLFI scams?

Double-check the official contract addresses before purchasing, and only follow WLFI’s verified account @worldlibertyfi on X for updates.

Why is WLFI so volatile?

Like most new tokens, WLFI’s price is influenced by speculative demand, limited liquidity, and uncertainty about its long-term role in the DeFi ecosystem.

Comments