Why Is The Crypto Market Up Today?

- Slava Jefremov

- Oct 7, 2025

- 3 min read

Updated: Nov 18, 2025

Key Takeaways

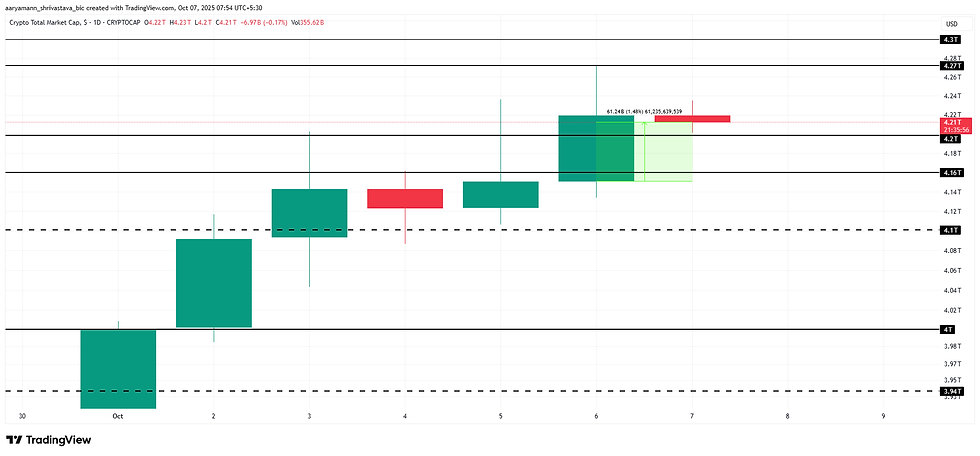

The total crypto market cap rose $61 billion to $4.21 trillion, peaking at $4.27 trillion as investors hedge amid U.S. shutdown uncertainty.

Bitcoin trades at $124,439 after reaching a $126,199 all-time high, with potential to climb toward $130,000 if bullish momentum sustains above $122,000.

MYX Finance surged 36% to $6.2 after rebounding from $5.0 support, aiming for $7.0 and $8.9 targets, though profit-taking could spark a correction.

Introduction

The cryptocurrency market continues to experience strong upward momentum, with the total crypto market capitalization (TOTAL) recently touching a new all-time high of $4.27 trillion. This impressive milestone was driven largely by Bitcoin (BTC), which crossed the $126,000 threshold to establish another record high within just 24 hours. At the same time, MYX Finance (MYX) became the standout performer of the day, rebounding by 36% from its recent lows.

The Crypto Market Spikes

The overall crypto market capitalization has increased by $61 billion in the past day, bringing the total value to $4.21 trillion at the time of writing. This marks one of the most notable single-day gains in recent weeks, with the market even touching a $4.27 trillion peak as investor confidence continues to build across major digital assets.

A key catalyst behind this rise is the ongoing uncertainty surrounding the U.S. government shutdown, which has prompted many investors to hedge against potential fiscal instability by turning to cryptocurrencies. As traditional markets fluctuate, digital assets are increasingly viewed as alternative stores of value, fueling this surge in demand.

If buying pressure remains strong, the TOTAL market cap may continue to hold above the $4.20 trillion support zone and potentially move higher in the coming days. This would reflect sustained optimism and a broader shift toward risk-on sentiment in digital asset markets.

However, if macroeconomic conditions stabilize or risk sentiment weakens, the market could face a pullback. A break below $4.20 trillion could push TOTAL toward $4.16 trillion, and further declines may even test the $4.00 trillion level.

Bitcoin Forms Another New ATH

Bitcoin (BTC) has once again taken center stage, currently trading around $124,439 after hitting a new all-time high (ATH) of $126,199. This marks the second consecutive record for BTC within a single week, underscoring the unprecedented strength of the current rally. The sustained upward momentum highlights both growing institutional demand and increasingly positive retail sentiment.

If bullish conditions continue, Bitcoin could extend its run beyond the $126,199 peak. A successful breakout above this level might drive BTC toward the $130,000 mark, setting yet another record high.

Still, traders should remain alert to potential retracements. Should Bitcoin fail to hold above $122,000, bearish pressure could send it lower toward $120,000. This would represent a short-term correction rather than a reversal, but losing that key support might cool the recent bullish enthusiasm.

MYX Finance Aims at Bouncing Back

MYX Finance (MYX) has captured significant attention as the best-performing altcoin in the market over the past 24 hours. The token surged 36%, recovering impressively from a close call near the $5.0 support level, and is now trading around $6.2.

If the strong buying momentum continues, MYX may soon challenge the $7.0 resistance level. A clean breakout above that threshold could accelerate its upward movement toward $8.9, marking new short-term highs and signaling a broader revival of bullish momentum across the altcoin market.

Nevertheless, the possibility of profit-taking among short-term investors cannot be ignored. If traders begin to secure recent gains, MYX could experience a pullback. A decline below $5.0 might trigger additional losses, potentially sending the token down to $3.45. Such a drop would invalidate the current bullish outlook and shift sentiment back toward caution.

Conclusion

The recent surge in the crypto market reflects renewed optimism amid global financial uncertainty. With the total market cap climbing past $4.21 trillion, Bitcoin achieving multiple all-time highs, and MYX Finance leading the altcoin recovery, the sector is showing robust resilience and investor confidence. Still, volatility remains a key factor, and traders should remain mindful of potential corrections if macroeconomic conditions shift or profit-taking intensifies. Overall, the market’s current strength suggests that digital assets continue to play an increasingly significant role in global investment strategies. Find this article useful? Read more in our Blog.

FAQs

Why is the crypto market rising today?

The market is climbing due to increased investor demand amid uncertainty surrounding the potential U.S. government shutdown. Many traders are turning to cryptocurrencies as alternative stores of value, boosting overall market capitalization.

What is Bitcoin’s current price target?

Bitcoin is trading near $124,439 and could aim for $130,000 if bullish momentum holds above $122,000. A drop below that level could trigger a short-term correction.

How high can MYX Finance go?

If current buying pressure persists, MYX could move past $7.0 and test $8.9 in the short term. However, if profit-taking occurs, the price might fall back toward $5.0 or even $3.45.

Could the crypto market correct soon?

Yes. If macroeconomic conditions improve or risk appetite declines, the total crypto market cap could drop below $4.20 trillion, with possible downside toward $4.00 trillion.

What does this mean for investors?

The rally indicates strong market confidence, but investors should approach with caution. While the uptrend may continue, volatility and sudden corrections remain inherent to crypto markets.

Comments