The New Battlefield of Onchain Trading: How Hyperliquid, Aster, and Lighter Are Competing for Dominance

- Slava Jefremov

- Oct 10, 2025

- 5 min read

Updated: Nov 27, 2025

Key Takeaways

The new wave of decentralized exchanges is shifting from token incentives to speed, leverage, and sustainable infrastructure.

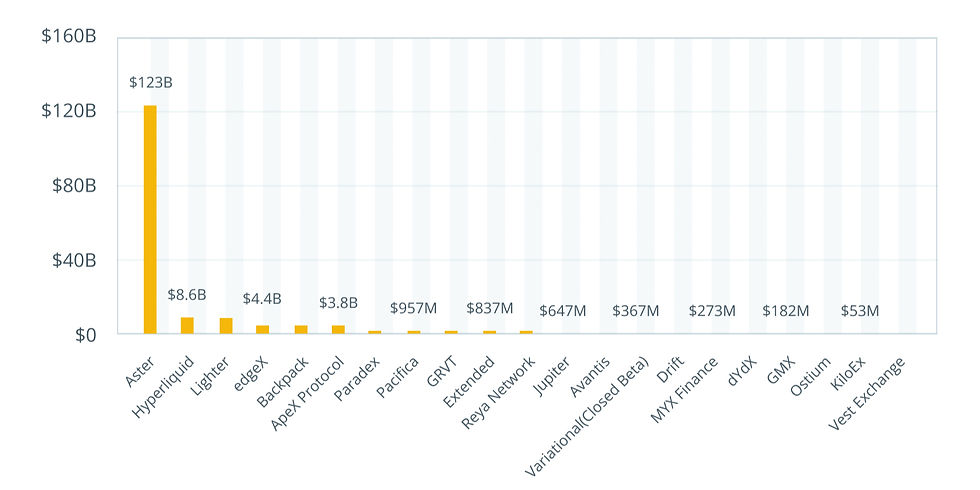

With over $300B monthly volume and a massive $7–8B airdrop, Hyperliquid dominates through deep liquidity and strong execution.

Backed by Binance’s CZ, Aster drives growth via aggressive airdrops, tokenized stocks, and 1,000x leverage.

Built on a ZK rollup, Lighter offers near-CEX latency, zero-fee retail trading, and a major upcoming airdrop worth up to $1.1B.

Professional traders and funds are entering onchain derivatives, signaling a move toward performance-driven, institutional-grade DEXs.

Introduction

The decentralized exchange (DEX) landscape is entering a new competitive era. After the first generation of yield farming and governance-token battles, the new phase emphasizes speed, leverage, and sustainable infrastructure. Hyperliquid currently leads the market with over $300 billion in monthly trading volume, while Aster and Lighter are rapidly emerging as strong challengers. Each platform is deploying unique mechanisms—from Binance-backed credibility to Ethereum layer-2 technology—to capture market share in the evolving perpetual DEX sector.

Evolution of the DEX Wars

Earlier decentralized exchanges such as SushiSwap, PancakeSwap, and Curve accelerated DeFi adoption through yield farming and governance token incentives. This strategy successfully attracted billions of dollars in total value locked (TVL) by rewarding liquidity providers with native tokens. However, those early contests primarily revolved around token incentives rather than technological infrastructure or execution quality.

As the market matured, the focus shifted from short-term token farming to long-term performance and professional-grade systems. The DEX model pioneered by Uniswap—liquidity mining, airdrops, and tokenized governance—laid the groundwork for a new generation of exchanges. Today’s perpetual DEXs are competing on deeper metrics: execution speed, leverage, and institutional readiness.

Inside the New Liquidity Race

Hyperliquid has emerged as the benchmark for this new class of DEXs. Built on a proprietary, high-performance blockchain, the platform achieved over $300 billion in trading volume by mid-2025, with daily peaks near $17 billion. Its success stems from a combination of deep liquidity, low latency, and an extensive reward program that distributed 27.5% of its token supply—valued between $7 billion and $8 billion—to 94,000 early users.

This massive airdrop catalyzed activity and established Hyperliquid as a central player in onchain derivatives. However, its dominance is now challenged by Aster and Lighter, which are employing their own incentive-driven models to capture traders’ attention and liquidity.

Aster’s High-Stakes Strategy for Market Leadership

Aster, operating on BNB Smart Chain, has positioned itself as one of Hyperliquid’s primary competitors. On some days, its trading volumes have reached the tens of billions of dollars, even temporarily surpassing Hyperliquid. The project’s connection to Changpeng “CZ” Zhao, Binance’s co-founder and now an advisor to Aster, has boosted investor confidence and reinforced its “Binance-linked” narrative.

Aster differentiates itself by introducing tokenized stocks and offering leverage of up to 1,000x. The exchange also plans to launch its own layer-1 blockchain, signaling its ambition to become a vertically integrated DeFi ecosystem.

The platform’s growth has been fueled by its aggressive airdrop programs. Season Two, which concluded on October 5, 2025, distributed 320 million Aster tokens worth approximately $600 million. This structure rewarded active traders and generated over $20 million in 24-hour fees, ranking Aster among the highest earners in DeFi. Market speculation suggests that part of these earnings may be allocated to token buybacks, potentially strengthening the token’s value post-airdrop.

The scale of Aster’s incentives has created opportunities for top traders to earn five- to seven-figure rewards, significantly boosting trading activity. The key challenge will be maintaining this momentum after reward-based incentives decrease.

Lighter’s Technological Edge and Incentive Mechanics

Lighter has adopted a distinctly technical approach to growth. Operating on a custom Ethereum rollup with zero-knowledge (ZK) circuits, it delivers sub-five-millisecond latency, approaching centralized exchange (CEX) speeds. Retail users trade with zero fees, while institutional and API users are charged premiums, allowing the platform to balance growth and profitability.

A major catalyst for Lighter’s rise is its Lighter Liquidity Pool (LLP)—a yield-generating mechanism offering 60% APY on over $400 million in deposits. Access to this pool depends on users’ points accumulation, which also influences eligibility for a forthcoming airdrop. This structure has led to vibrant market speculation, with over-the-counter (OTC) trading of Lighter points reaching $60 each, up from $39, and one trader reportedly spending $1 million at $41 per point.

From a valuation perspective, Lighter’s open interest (OI) stands at $2.1 billion, compared to Hyperliquid’s $13.2 billion. Assuming 15–20% of tokens unlock during its token launch, analysts project a circulating market capitalization of $1–1.1 billion and a fully diluted valuation (FDV) between $5 billion and $5.5 billion. The estimated community allocation of 15–20% suggests a potential airdrop worth $750 million to $1.1 billion, making it one of DeFi’s most anticipated events since Hyperliquid’s distribution.

Institutional Capital Begins to Flow

Institutional adoption represents a critical new dimension in the onchain derivatives market. Hedge funds and proprietary trading firms that previously avoided decentralized derivatives due to slippage, latency, and compliance issues are now entering cautiously with test allocations.

Hyperliquid’s robust infrastructure and transparency appeal to professional traders seeking CEX-level performance. Aster’s association with Binance has resonated strongly in Asian trading communities, while Lighter’s low-latency, onchain settlement model has attracted prop trading firms interested in high-speed execution with reduced counterparty risk.

The outcome of this institutional migration may determine which platform becomes the long-term standard for onchain derivatives.

Infrastructure Versus Narrative: The Strategic Divide

The divergence in strategies among the three exchanges illustrates the maturing DEX ecosystem. Hyperliquid continues to focus on execution quality, liquidity, and platform extensibility, introducing HIP-3 to enable anyone to deploy new perpetual markets on its network. The exchange also launched USDH, its native stablecoin, and listed perpetuals for competitor tokens such as ASTER, capturing liquidity driven by narrative momentum.

To sustain community engagement, Hyperliquid introduced the Hypurr NFT collection on September 28, 2025. With floor prices near 1,200 HYPE (roughly $55,000 per NFT), it has become one of the most sought-after digital assets in its ecosystem, fueling speculation about future reward mechanisms.

According to Calder White, CTO of Vigil Labs, which recently raised $5.7 million to apply AI in crypto trading, the market split is clear:

“Hyperliquid is betting on execution and liquidity, while Aster and Lighter are showing just how far incentives can stretch the market. The real test will be whether traders stay once the airdrop music fades.”

Conclusion

The current DEX landscape reflects a transition from token-driven growth to sustainable, infrastructure-oriented competition. Hyperliquid holds a commanding lead through liquidity and institutional integration, Aster combines narrative-driven adoption with deep financial incentives, and Lighter pushes the frontier of low-latency DeFi trading.

Ultimately, the winner of this new era of onchain trading will be defined not by temporary airdrops but by the ability to provide consistent performance, deep liquidity, and institutional-grade trust. As the DEX ecosystem matures, sustained innovation and credible execution will replace speculative enthusiasm as the primary drivers of dominance.

Frequently Asked Questions

What differentiates Hyperliquid, Aster, and Lighter from traditional DEXs?

They focus on perpetual futures trading, advanced leverage, and CEX-level execution speeds rather than simple token swaps.

How did Hyperliquid’s airdrop impact the market?

Its $7–8 billion token distribution incentivized trading and became one of DeFi’s most valuable airdrops, setting a benchmark for future campaigns.

Why is Aster often called “Binance’s DEX”?

Because of its advisory connection with Changpeng “CZ” Zhao, Binance’s co-founder, which has led to strong associations with the Binance ecosystem.

What is Lighter’s main advantage?

Lighter’s Ethereum layer-2 ZK rollup architecture enables sub-five-millisecond latency and zero-fee retail trading, giving it a technological edge.

What role does institutional capital play in this competition?

Institutions are testing these DEXs for the first time, attracted by improved infrastructure and reduced counterparty risks, signaling a long-term shift toward onchain derivatives.

Comments