How Hodling Bitcoin Looks Like in 2025

- Slava Jefremov

- Aug 19

- 5 min read

Key Takeaways

Hodling is the long-term strategy of holding Bitcoin regardless of volatility, rooted in behavioral finance and loss aversion psychology.

In 2025, over 70% of Bitcoin supply has not moved in over a year, signaling strong long-term conviction among both retail and institutional investors.

Institutional adoption is at record levels, with US spot Bitcoin ETFs now holding over $94.17 billion in assets under management.

Despite risks like regulation, CBDCs, and ESG debates, Bitcoin remains a leading macro asset, with long-term projections ranging from $100K+ today to $1M+ by 2030.

Hodlers now have access to advanced tools, from cold wallets and multisig setups to yield-generating platforms like Lido, Babylon, and tokenized T-bills.

Introduction

Cryptocurrency has always been synonymous with volatility, speculation, and hype-driven cycles. Yet, amidst the chaos, a simple yet powerful investment philosophy has stood the test of time: hodling. What started as a drunken typo on a Bitcoin forum back in 2013 has evolved into a cornerstone strategy for long-term crypto investors. In 2025, as Bitcoin matures into a recognized global macro asset and institutional adoption accelerates, hodling remains as relevant as ever.

This article explores the origins of hodling, why the mindset still works today, how it fits into the 2025 market environment, and what tools and platforms are available for hodlers. By the end, you’ll understand not only what hodling means but also why it continues to be a cornerstone of Bitcoin investing in an era of ETFs, central bank digital currencies (CBDCs), and onchain financial products.

The Origin of Hodling

Hodling crypto means holding onto cryptocurrency long-term instead of selling, regardless of market volatility.

The term dates back to 2013, when a frustrated user on the Bitcointalk forum posted: “I AM HODLING.” The misspelling of “holding,” made after a few drinks and in the middle of a market downturn, went viral. What began as a typo turned into a movement and eventually a philosophy: resist the temptation to sell during volatility and instead focus on long-term conviction.

Over the years, “HODL” transformed from a meme into a mindset. In a market driven by hype, fear of missing out (FOMO), and speculative 100x trades, hodling became a radically simple alternative: buy Bitcoin and don’t sell.

Fast forward to 2025, the financial world looks dramatically different, yet hodling remains central. Central banks continue to grapple with inflation, institutional adoption is at all-time highs, and Bitcoin is now recognized globally as a macro hedge. Hodling is no longer just an internet joke—it’s an investment thesis validated by a decade of performance.

Hodling as a Behavioral Strategy

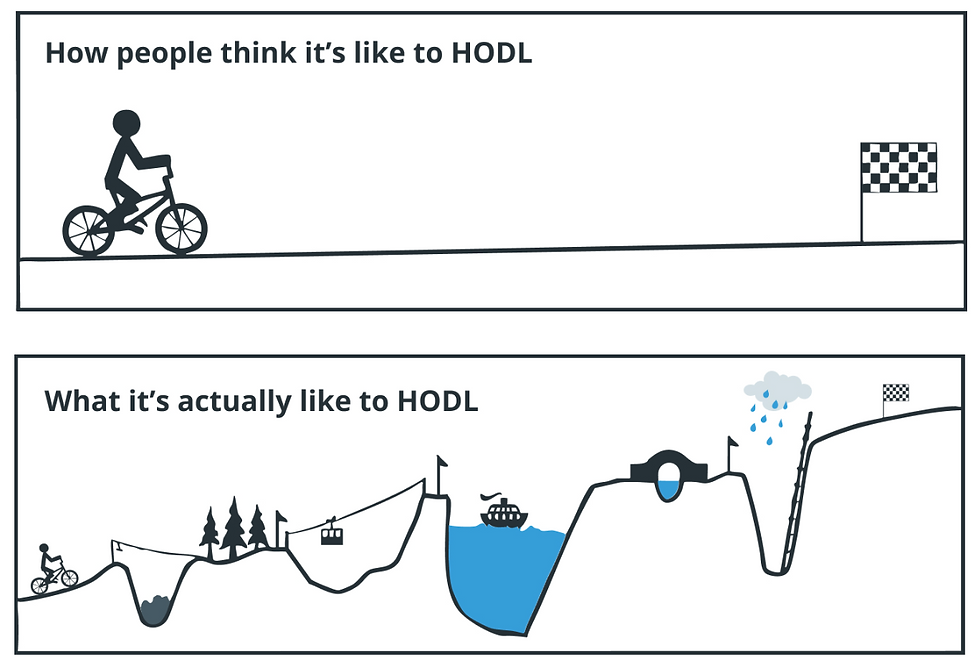

At its core, hodling is as much about psychology as it is about finance.

In behavioral economics, loss aversion—a concept researched by Nobel Prize winner Daniel Kahneman—suggests that people feel losses about twice as strongly as equivalent gains. In a market where 20% daily swings are common, this bias often leads to panic selling at the bottom or reckless FOMO buying near the top.

Hodlers counteract this by embracing what the community calls “diamond hands.” Rather than trying to time every dip and peak, they commit to long-term conviction. This stoic mindset aligns with Bitcoin’s evolving role in 2025 as a store of value, comparable to gold.

Data backs this up: according to CoinShares, more than 70% of Bitcoin’s supply hasn’t moved in over a year, the highest level ever recorded. Much of this is held not just by retail believers but also by ETFs, pension funds, and even sovereign wealth funds.

In short, hodling is no longer just a meme—it’s behavioral finance in action, shaping modern portfolio strategies.

Is Hodling Still Relevant?

The past few years have tested even the most resilient hodlers. From the FTX collapse to aggressive regulatory crackdowns, global inflation, and a brutal bear market, Bitcoin has weathered storm after storm. And yet, in May 2025, it stood at new all-time highs.

In 2020, Bitcoin traded under $10,000.

By May 2025, it has surged to nearly $112,000, cementing its bull market status.

Institutional inflows have played a major role. For instance:

BlackRock’s iShares Bitcoin Trust (IBIT) attracted nearly $7 billion in 2025 alone, marking a 16-day streak of positive inflows.

ETFs from Fidelity and ARK Invest have also captured billions in demand.

Collectively, US spot Bitcoin ETFs now manage over $94.17 billion in assets under management (AUM).

But the environment isn’t without challenges:

Regulation is intensifying, with some countries considering capital controls on crypto.

CBDCs are being rolled out across Europe and Asia, reshaping how governments view digital money.

Tokenized US Treasuries now offer yields above 5% onchain, presenting alternatives to Bitcoin.

ESG debates remain heated, despite the Bitcoin Mining Council reporting that more than 50% of mining is renewable-powered.

Still, long-term projections remain bullish. The stock-to-flow model suggests six-figure valuations ahead, while ARK Invest has modeled a potential $1M+ Bitcoin by 2030. Fidelity likewise continues to highlight Bitcoin’s strong long-term adoption curve.

Bitcoin Hodling in Practice: Tools and Platforms in 2025

Hodling today is more sophisticated than simply locking coins away. A wide ecosystem of tools now supports both retail and institutional long-term holders.

Storage Options: Cold vs. Hot Wallets

Cold wallets (offline) remain the gold standard for long-term security. Devices like Ledger, Trezor, and Ellipal Titan dominate this space.

Hot wallets (online) have improved dramatically. Options like Sparrow, BlueWallet, and browser-based Nostr wallets now integrate with multisig and decentralized identity systems for safer access.

Institutional-Grade Custody & Yield

For wealthier hodlers and institutions:

Custodians like Fidelity Digital Assets, Coinbase Custody, and BitGo provide regulated, insured vaults.

New yield options allow hodlers to earn while holding:

Lido now offers Bitcoin staking derivatives.

Liquid and Babylon experiment with BTC-native staking models.

Tokenized T-bill vaults and BTC-backed stablecoins give yield opportunities akin to long-term savings accounts.

Automation & Portfolio Tools

Hodling can now be automated for efficiency:

Platforms like Swan Bitcoin and River Financial enable recurring buys with automatic cold storage withdrawals.

Services like Casa and Unchained Capital offer advanced multisig inheritance and recovery planning.

Tools like Zaprite and Timechain Calendar let hodlers track growth without exposing wallet data.

Conclusion

In 2025, hodling is no longer just an inside joke from the early Bitcoin forums. It is a tested, institutionalized strategy that has survived bear markets, regulatory pressure, and the rise of alternative digital assets. With Bitcoin trading above $100K, institutional inflows at record levels, and more tools available than ever, hodling continues to represent one of the most resilient and rewarding long-term approaches in crypto.

While challenges remain—regulation, CBDCs, and ESG debates—hodling has proven to be more than a meme. It is a disciplined approach rooted in behavioral finance, validated by history, and powered by conviction.

For those willing to think in years rather than days, hodling remains not just relevant but essential.

FAQs

What does HODL stand for in crypto?

Originally a misspelling of “hold” in a 2013 forum post, HODL now means holding Bitcoin long-term without selling during volatility.

Is hodling still a good strategy in 2025?

Yes. With Bitcoin trading at nearly $112K, over 70% of supply locked up for over a year, and institutional inflows at record levels, hodling has proven effective.

How do hodlers store Bitcoin securely?

Most use cold wallets like Ledger or Trezor. Institutions often rely on custodians like Fidelity Digital Assets or Coinbase Custody.

Can hodlers earn yield on Bitcoin today?

Yes. Platforms like Lido, Babylon, and tokenized T-bill vaults let hodlers generate yield while maintaining Bitcoin exposure.

What are the risks of hodling?

Regulatory changes, rising CBDCs, ESG debates, and alternative yield products are challenges. However, Bitcoin’s long-term adoption and scarcity make hodling attractive for many investors.

Comments