93% of Bitcoin is Already Mined – What Happens Next?

- Slava Jefremov

- Aug 19

- 5 min read

Key Takeaways

93% of Bitcoin is mined, leaving 1.4M BTC to be created by 2140.

3–3.8M BTC are lost, reducing real supply to ~16–17M.

Scarcity is stronger than gold since lost coins can’t return.

Mining stays secure via difficulty adjustment despite shrinking rewards.

52–59% of mining uses renewables, with a growing shift to clean energy.

Introduction

Bitcoin has always been defined by its scarcity, a digital asset with a hardcoded supply cap of 21 million coins. Unlike traditional currencies that can be printed indefinitely, Bitcoin’s protocol enforces this strict upper limit, ensuring that no more than 21 million BTC will ever exist. As of May 2025, over 93% of that supply has already been mined, sparking growing curiosity about what comes next for the world’s first decentralized cryptocurrency.

How much Bitcoin is left to mine? What happens when the last coin is created? How do lost coins affect scarcity? And what does this mean for miners, investors, and the future of the Bitcoin network? Let’s explore.

How Much Bitcoin Is Left to Mine?

Bitcoin’s supply schedule is written into its protocol and cannot be changed without fundamentally breaking consensus. The fixed 21 million BTC cap is central to Bitcoin’s value as a deflationary asset.

As of May 2025, roughly 19.6 million Bitcoin have been mined, which equals 93.3% of the maximum supply. This leaves about 1.4 million BTC yet to be created — but those remaining coins will be released very gradually.

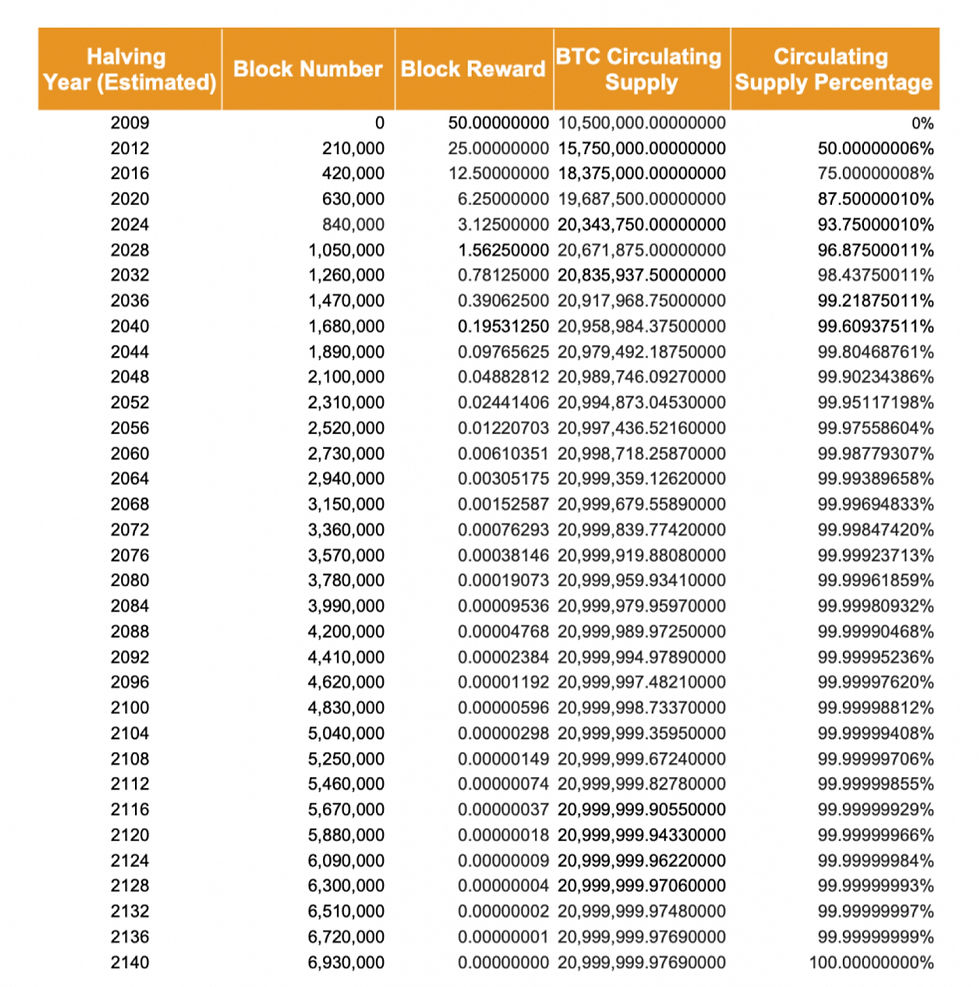

The reason lies in Bitcoin’s halving mechanism, which slashes mining rewards every 210,000 blocks (about every four years). When Bitcoin launched in 2009, miners received 50 BTC per block. By 2020, that figure had dropped to 6.25 BTC, and following the 2024 halving, miners now earn 3.125 BTC.

Because of this exponential reward reduction, more than 87% of the total supply had already been mined by 2020. But the final 6.7% will take over a century to issue. Current projections suggest that 99% of Bitcoin will be mined by 2035, yet the very last satoshis won’t appear until around 2140.

This engineered scarcity mirrors commodities like gold, but Bitcoin’s supply trajectory is even more transparent and predictable. While gold supply grows at roughly 1.7% annually, Bitcoin’s inflation rate keeps falling, making it the hardest asset in existence.

Beyond the Supply Cap: Lost Coins and Hidden Scarcity

While 93% of Bitcoin has technically been mined, not all of it is accessible. A large portion of Bitcoin is permanently lost due to forgotten keys, destroyed hard drives, or wallets abandoned by early adopters.

Research from firms such as Chainalysis and Glassnode estimates that between 3.0 million and 3.8 million BTC — or 14% to 18% of the total supply — may be gone forever. Among these are famous dormant addresses, including the one believed to belong to Satoshi Nakamoto, holding over 1.1 million BTC untouched since Bitcoin’s creation.

This means that the real circulating supply could be closer to 16–17 million BTC, not 21 million. And because Bitcoin is non-recoverable by design, lost coins are lost forever, further tightening effective supply.

Gold offers an illuminating comparison. Around 216,265 metric tons of gold — roughly 85% of total supply — has been mined and remains available in circulation, vaults, ETFs, or jewelry. Gold can be recycled and remelted, but Bitcoin can never be reissued once access is lost.

This gives Bitcoin a unique form of “hardening scarcity.” Not only does supply growth decline over time, but the usable supply may even shrink, amplifying scarcity and potentially increasing long-term value.

Possible outcomes of this dynamic include:

More price volatility as liquid supply contracts relative to market demand.

Value concentration among those who actively safeguard their keys.

A liquidity premium, where spendable BTC may trade at higher effective value than inaccessible supply.

In extreme cases, the market could differentiate between circulating BTC and unreachable BTC, giving economic weight only to coins that remain usable.

What Happens When Bitcoin Is Fully Mined?

A common misconception is that once block rewards disappear, Bitcoin’s security model will collapse. In reality, Bitcoin’s mining incentives are adaptive and resilient.

The system is designed with a self-correcting feedback loop. If mining becomes unprofitable, miners leave the network. This triggers the difficulty adjustment mechanism, which recalibrates every 2,016 blocks (about two weeks) to keep block times stable at ~10 minutes. As difficulty falls, remaining miners benefit from lower costs.

This resilience has already been tested. In 2021, when China banned mining, the network’s global hashrate dropped by over 50% within weeks. Yet Bitcoin continued to operate without disruption, and the hashrate fully recovered as miners migrated to energy-friendly jurisdictions.

The idea that declining block rewards automatically endanger security ignores how mining profitability works. Miners care about margins, not nominal rewards. As long as Bitcoin’s price sustains operational costs, even rewards like 0.78125 BTC per block (post-2028 halving) will be enough to incentivize mining.

Even when rewards approach zero a century from now, Bitcoin will still be secured by transaction fees, infrastructure efficiency, and market demand. The adaptive difficulty system ensures that Bitcoin remains one of the most resilient monetary networks ever built.

The Future of Bitcoin Mining

A persistent narrative is that rising Bitcoin adoption will endlessly drive up energy consumption. But this overlooks how mining economics actually work.

Mining is profitability-constrained, not price-constrained. Higher BTC prices attract more miners, which increases difficulty, compresses margins, and naturally limits energy growth.

Since China’s 2021 mining ban, hash power has shifted toward North America, Northern Europe, and energy-abundant regions, where miners leverage cheap renewables like hydro, wind, and surplus grid capacity.

According to the Cambridge Centre for Alternative Finance, between 52% and 59% of Bitcoin mining now uses renewable or low-emission energy sources. Many jurisdictions are reinforcing this trend through incentives for clean-powered mining and penalties for fossil-fuel-based operations.

While renewable-based mining introduces challenges, the dystopian vision of endless fossil-fueled Bitcoin consumption is increasingly unrealistic. Instead, mining continues to evolve toward efficiency and sustainability.

Conclusion

Bitcoin’s future is defined by scarcity, security, and adaptability. With 93% of supply already mined and millions of coins permanently lost, the real availability of Bitcoin is far tighter than most realize. The protocol’s halving cycle ensures a predictable issuance decline, while the difficulty adjustment secures resilience regardless of mining profitability.

Far from collapsing, Bitcoin has shown it can adapt to regulatory shocks, geographic shifts, and economic changes without missing a beat. Meanwhile, the industry’s pivot toward renewable energy highlights how Bitcoin’s growth can align with sustainability.

As the remaining 1.4 million coins are mined over the next century, Bitcoin will continue to cement its role as the hardest, most predictable, and most transparent monetary network in history.

FAQs

When will the last Bitcoin be mined?

Projections suggest the final satoshis will be mined around the year 2140, due to the halving mechanism.

How many Bitcoins are lost forever?

Estimates range from 3.0 to 3.8 million BTC, or 14%–18% of total supply, permanently lost to inaccessible wallets and lost private keys.

Will Bitcoin mining stop when all coins are mined?

Yes, but miners will still earn revenue from transaction fees, which will sustain network security alongside efficiency improvements.

Does Bitcoin waste energy?

No. Mining energy use is capped by profitability, not price alone. Today, 52–59% of mining uses renewables, and the share is growing.

What makes Bitcoin scarcer than gold?

Gold’s supply grows by 1.7% annually and is recyclable. Bitcoin, by contrast, has a fixed 21 million cap and permanently lost coins, making its scarcity unique and hardening over time.

Comments