Ethereum Price Could Surpass $8,500 if Bitcoin Hits $150K, Analyst Predicts

- Slava Jefremov

- Aug 14, 2025

- 3 min read

Updated: Dec 9, 2025

Key Takeaways

Historical pattern: ETH often reaches 30%–35% of BTC’s market cap in major bull runs.

Price projection: If BTC hits $150K, ETH could range from $5,376 to $8,656.

Institutional momentum: $20B ETH acquisition plans and record ETF inflows support bullish sentiment.

Short-term target: ETH is less than 6% away from its all-time high.

Wider market optimism: Analysts see BTC potentially reaching $250K by 2025.

Introduction

Ethereum (ETH) may be on the verge of a significant rally if Bitcoin (BTC) reaches the highly anticipated milestone of $150,000. Historical market patterns suggest that Ether often trails Bitcoin’s market capitalization by a predictable margin during bull runs, which could push ETH to new record highs. A prominent crypto trader has laid out a case—supported by market data, institutional momentum, and ETF inflows—that Ethereum could climb beyond $8,500 under favorable conditions.

Historical Market Trends Point to Potential ETH Surge

Crypto trader Yashasedu shared an analysis on X (formerly Twitter) showing that, in past bull runs, ETH typically captures 30%–35% of Bitcoin’s market capitalization. For example, during the 2021 bull market, Ethereum rose to achieve 36% of Bitcoin’s then-market cap.

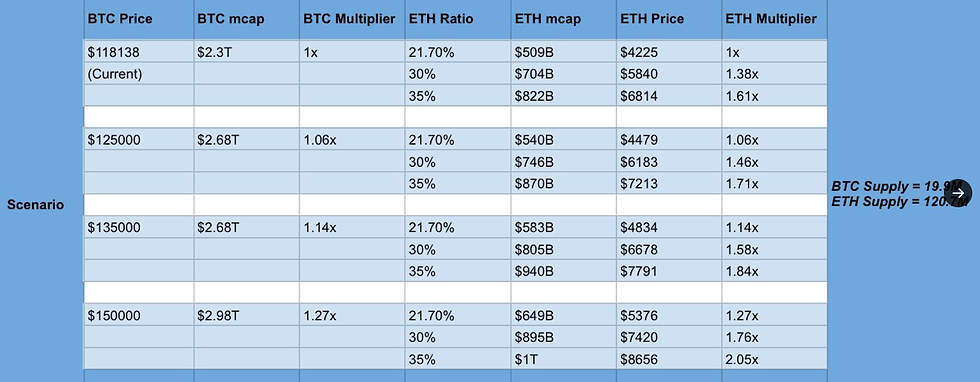

This ratio forms the basis of Yashasedu’s current forecast. If Bitcoin rises to $150,000—which would represent a 25% increase from its current level of $119,335—and ETH maintains the historical 35% share of BTC’s market cap, Ethereum’s price could reach approximately $8,656.

Even under more conservative scenarios where ETH’s market cap ratio ranges between 21.7% and 30%, the price could still trade between $5,376 and $7,420.

Analyst Consensus Favors Bitcoin’s Climb to $150K+

Yashasedu’s projections align with the bullish sentiment among several well-known industry figures. Fundstrat co-founder Tom Lee, BitMEX co-founder Arthur Hayes, and Unchained market research director Joe Burnett have each predicted that Bitcoin could climb as high as $250,000 by the end of 2025.

The trader also highlighted the strong backdrop for Ethereum’s growth:

Total Value Locked (TVL) in Ethereum’s ecosystem has recently surpassed $90 billion.

Institutional interest is rising, particularly in Ether exchange-traded funds (ETFs).

The market is showing structural similarities to past bull cycles where ETH outperformed following Bitcoin’s rally.

Institutional Demand and ETF Flows Boost Outlook

Institutional moves into Ethereum are intensifying. On Tuesday, blockchain technology firm BitMine Immersion Technologies announced plans to raise up to $20 billion for ETH purchases.

Adding to the momentum, spot Ether ETFs recorded their largest single-day net inflow ever just a day earlier—totaling $1.01 billion across all funds. These developments bolster the case for a sustained upward trend in ETH’s valuation.

Short-Term Price Action and All-Time High Watch

In the near term, market watchers are keenly focused on whether Ethereum will reclaim its all-time high. According to CoinMarketCap data, ETH is currently trading at $4,630, which is 5.35% below its November 2021 peak of $4,878.

Yashasedu does not expect a significant pullback before ETH surpasses its all-time high. This view is shared by MN Trading Capital founder Michaël van de Poppe, who anticipates that ETH will set a new record before entering a period of consolidation.

Conclusion

Ethereum’s potential path to $8,500+ is closely tied to Bitcoin’s ability to reach $150K in the ongoing bull market. Historical trends, growing institutional demand, record ETF inflows, and a robust DeFi ecosystem all strengthen the case for significant ETH gains in the months ahead. While markets remain volatile, both short- and long-term indicators suggest Ethereum could soon reclaim—and surpass—its previous records.

Frequently Asked Questions

Why does Ethereum’s price often track a percentage of Bitcoin’s market cap?

Historically, ETH has tended to follow BTC’s market dominance cycles, often capturing 30–35% of Bitcoin’s total market value during peak bull phases.

Could ETH reach $8,500 even if BTC doesn’t hit $150K?

While possible through independent catalysts, historical patterns suggest such a move is more likely if BTC achieves a major milestone.

What role do ETFs play in ETH’s price growth?

ETFs make it easier for institutions and retail investors to gain exposure to ETH, increasing demand and potentially pushing prices higher.

How close is ETH to its all-time high right now?

As of the latest data, ETH trades at $4,630—about 5.35% below its record of $4,878 set in November 2021.

Comments