Bybit EU Unveils AI-Powered Tools and Bybit Card to Redefine Crypto Use in Europe

- Slava Jefremov

- Oct 13, 2025

- 5 min read

Updated: Nov 25, 2025

Key Takeaways

Bybit EU introduces AI-driven bots, Spot Margin, and the Bybit Card under MiCAR, merging innovation with compliance.

Lite Mode simplifies crypto trading for beginners, while Pro Mode offers full control for experienced traders.

Nasdaq-powered market surveillance ensures transparency, strengthening trust and discipline in European crypto markets.

Introduction

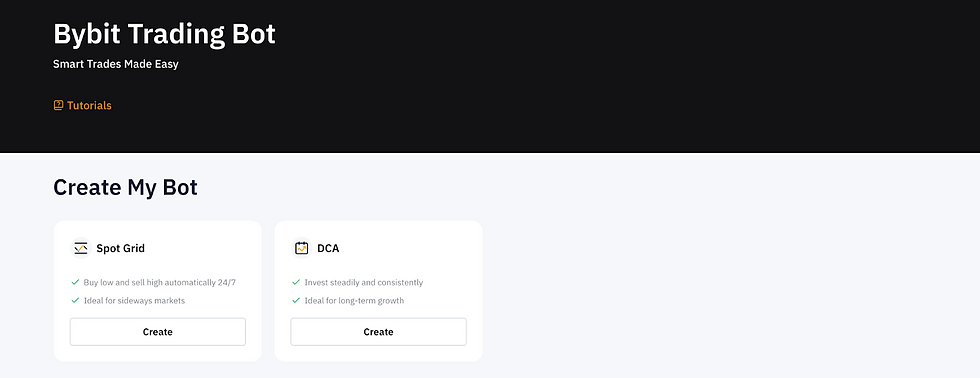

Bybit EU has launched a comprehensive lineup tailored for European users, blending automation, compliance, and usability. The new offerings include AI-powered DCA and Grid trading bots, the Bybit Card, Spot Margin, and a simplified Lite Mode — all designed under the MiCAR (Markets in Crypto-Assets Regulation) framework.

Together, these updates aim to empower users to trade, invest, and spend crypto more confidently within a regulated European environment.

Bybit EU’s Expansion Under MiCAR Compliance

Bybit EU, the exchange’s fully licensed European branch headquartered in Vienna, operates under MiCAR authorization from Austria’s regulators. This license enables Bybit to serve users across the European Economic Area (EEA) via regulatory “passporting,” which allows operations in up to 29 countries, depending on each state’s implementation schedule.

Bybit EU has also partnered with Nasdaq to adopt its Market Surveillance technology, a sophisticated system designed to detect potential market manipulation and ensure compliance with MiCAR’s strict oversight requirements.

The 2025 rollout introduces a balanced mix of automation and accessibility, including AI-assisted bots (DCA and Grid), Spot Margin trading, Lite Mode, and the Bybit Card — all aimed at creating safer, more transparent crypto participation across Europe.

Mazurka Zeng, CEO of Bybit EU, emphasized the importance of automation in disciplined investing:

“Automation plays an important role in helping users approach crypto markets with greater consistency and control. With DCA and Spot Grid now available on Bybit.eu, we’re making it easier for millions across Europe to access structured trading tools that support safer participation,” she said.

DCA Bot: Building Consistency Through Automation

The Dollar-Cost Averaging (DCA) Bot helps users invest steadily by purchasing selected cryptocurrencies at fixed intervals — daily, weekly, or monthly — regardless of price movements. This strategy smooths out entry prices over time and reduces the emotional impact of market volatility.

Bybit’s DCA Bot enhances this process with data-driven insights based on real-time market trends, helping users tailor their automated strategies. Every setting — from trading pair and investment frequency to duration and amount — is fully customizable.

How to set it up:

Navigate to “Trading Bots” on Bybit EU’s platform.

Choose DCA Bot.

Select your trading pair (e.g., XRP/USDC).

Define investment amount and frequency.

Launch and track your plan via the dashboard.

The bot executes each order automatically, and users can pause, adjust, or stop it anytime. It’s particularly suited for long-term investors seeking steady accumulation rather than constant chart monitoring. Bybit applies standard spot trading fees only, with no separate bot fees.

Grid Bot: Capturing Market Fluctuations

The Spot Grid Bot allows traders to profit from regular price swings by placing sequential buy and sell orders within a predetermined range — essentially buying low and selling high repeatedly within that grid.

Bybit’s Grid Bot enables full customization of parameters such as price range, investment size, and advanced controls like Stop Loss, Take Profit, and Trailing-Up (which automatically adjusts the grid upward when the market rises).

Note: The Trailing-Up feature is distinct from a standard trailing stop order.

How to use the Spot Grid Bot:

Open Trading Bots on Bybit EU.

Select Spot Grid Bot.

Choose your trading pair (e.g., XRP/USDC).

Define your upper and lower price limits.

Set the number of grid levels — each representing a price level for automated trades.

Enter your total investment amount.

Adjust optional features like Stop Loss, Take Profit, or Trailing-Up.

Launch and monitor the bot’s performance in real time.

This approach is most effective in sideways or range-bound markets, where it captures small profits from oscillating prices. If prices move outside the set range, the bot pauses until the market returns.

As with the DCA Bot, only standard trading fees apply.

Spot Margin Trading: Amplify Opportunities Responsibly

Bybit EU’s Spot Margin feature enables verified users to borrow funds and expand position sizes — typically up to 2× leverage, and up to 10× on select pairs.

While leverage magnifies potential profits, it also increases risk exposure. Bybit integrates real-time margin alerts, collateral tracking, and liquidation thresholds directly into the interface to ensure transparency and regulatory compliance.

Currently, Spot Margin supports pairs such as BTC/USDC, ETH/USDC, SOL/USDC, and others. Users must complete risk acknowledgment steps before activating leverage, aligning with MiCAR’s consumer protection standards.

Lite Mode: Streamlined Experience for Everyday Traders

The Lite Mode offers a simplified interface, removing complex charts and advanced order types. Users can easily buy, sell, or stake crypto with just a few taps.

Traders can switch between Lite Mode and Pro Mode using the same verified account. Lite Mode is also linked directly to the DCA Bot, allowing small automated purchases without opening the full trading dashboard — making crypto participation simpler and more intuitive.

Bybit Card: Turning Crypto into Everyday Currency

The Bybit Card, issued through Mastercard, brings digital assets into daily life by converting crypto holdings into fiat currency at the point of sale. It supports major assets such as BTC, ETH, and USDC, which is gaining popularity over USDT in certain regions.

When a user makes a purchase, Bybit automatically converts the chosen crypto into euros or local fiat using its internal exchange. The card integrates seamlessly with European payment systems and is accepted at any merchant supporting Mastercard.

Users can top up instantly, track spending, and manage their card directly from the Bybit EU dashboard. Security measures include instant card freeze/unfreeze and 2FA protection, all under MiCAR-compliant custody.

Bybit has launched cashback promotions of up to 20% on eligible purchases to encourage adoption, with conditions varying by region.

Risk Management and Best Practices

Bybit EU’s new lineup promotes safer automation, but not risk-free trading. Automation enhances discipline, not guarantees.

1. Trading Bots

The DCA Bot continues to buy during downturns, potentially deepening unrealized losses.

The Grid Bot may halt if prices exceed its range, leaving open positions.Tip: Start small, test configurations, and focus on long-term consistency.

2. Spot Margin

Leverage can accelerate losses as much as gains. Monitor your collateral and never borrow to full capacity.

Bybit issues warnings for low margin levels, but manual vigilance remains essential.

3. Lite Mode

Simplicity doesn’t remove risk. Double-check orders before confirming purchases or recurring setups.

4. Bybit Card

Crypto converts at real-time market rates. Sudden price drops may affect conversion value.

Consider using stablecoins like USDC or EUR-pegged tokens to reduce volatility.

5. General Safety

Enable 2FA and keep API keys private.

Avoid third-party bot integrations.

Pause bots before major volatility events.

Diversify across strategies rather than relying solely on automation.

Bybit EU’s MiCAR-based framework introduces greater accountability, yet informed decision-making remains the trader’s best protection.

Conclusion

Bybit EU’s 2025 lineup represents a decisive step toward structured, compliant, and accessible crypto adoption across Europe. With AI-powered bots, Spot Margin trading, Lite Mode, and the Bybit Card, users can automate strategies, manage risk, and even spend crypto — all within a MiCAR-regulated environment.

For European traders, this signals a new era of innovation balanced with accountability, where advanced crypto tools coexist with strong regulatory oversight.

Frequently Asked Questions

Who can use these tools on Bybit EU?

All verified users within the European Economic Area (EEA) — except in regions not yet passported, such as Malta — can access Bybit EU’s services. Availability may vary depending on local regulations.

Are there any extra fees for trading bots?

No, Bybit does not charge additional bot fees. Only standard trading fees apply to each automated transaction.

What happens if the market moves beyond my grid range?

If the market price leaves your defined range, the Grid Bot pauses trades until prices return. You can modify the grid range anytime or enable Trailing-Up to adjust automatically as the market rises.

Is Spot Margin trading risky?

Yes. While leverage increases potential returns, it also heightens exposure to liquidation. Always monitor margin ratios and collateral levels closely.

How secure is the Bybit Card?

The Bybit Card operates under MiCAR-regulated custodial standards, with 2FA, instant freeze/unfreeze options, and real-time monitoring from the user dashboard.

Comments