Best DeFi Staking Platforms in 2025

- Slava Jefremov

- Jun 19, 2025

- 7 min read

Updated: Dec 18, 2025

Introduction

In 2025, DeFi staking has become one of the most reliable ways to generate passive income from crypto holdings. As blockchain technology matures and Proof-of-Stake (PoS) protocols dominate, DeFi staking platforms offer investors a secure and flexible way to earn yield without giving up control of their assets. Stick around as we dig into the standout DeFi staking platforms that are really setting the bar in 2025. Each one brings something special to the table, helping you figure out where to put your money for the best bang on your staking journey. This guide explores the best DeFi staking platforms of the year, how they work, and what makes them stand out in a competitive landscape.

Key Takeaways

DeFi staking allows crypto holders to earn passive income while contributing to blockchain security.

Top platforms include Lido, Rocket Pool, Coinbase, Binance Earn, and EigenLayer.

Factors to consider: APY rates, supported tokens, platform security, and smart contract audits.

Liquid staking and restaking have gained traction for offering greater flexibility and yield stacking.

DeFi staking comes with risks such as smart contract vulnerabilities and slashing penalties.

Benefits of Crypto Staking

Crypto staking is like the side hustle for your digital coins, bringing extra profits while cheering on the blockchain parade. Let’s break down why jumping on the staking train is a win-win.

Earning Passive Income

Staking is the magic wand that lets your crypto multiply while you kick back with a cup of joe. Think of it as collecting rent from a tenant– only this time, your tenant is a digital coin. Those sweet annual percent yields (APYs) can range from a modest few points to more than 20%—so tempting, right? No need to part with your precious assets; you just let them do their thing and watch the dough roll in.

Supporting Blockchain Networks

When you stake, you're more than an investor; you're a part of the blockchain fam. Stakeholders keep the network buzzing smoothly and get some rewards too. But this isn’t a free-for-all–if anyone tries to pull a fast one, they’ll see their tokens sliced like day-old bread. Everyone behaves, the network stays honest, and the blockchain smiles.

Promoting Decentralization

Staking is the champion for spreading the power around, making sure no one player calls all the shots on the network. It works like a trustworthy friend group, keeping everything fair and balanced in the world of blockchain.

Flexibility with Liquid Staking

Liquid staking is a nifty feature that lets you have your cake and eat it, too. Say hello to platforms like Lido's stETH and Rocket Pool's rETH, which let you stay active in the DeFi scene while still pocketing those sweet, sweet staking rewards. You can go about your business, trade, lend, or just cash in without losing any perks.

Tapping into these staking perks can pump up your crypto wallet, all the while giving back to the DeFi community. For a deeper dive into what DeFi staking is, peek at our full guide.

Factors to Consider When Choosing DeFi Staking Platforms

Picking the right place to park your crypto for staking in DeFi is like trying to find the best parking spot at a concert—there's a lot to consider to get the best rewards and keep those assets working hard for you.

Staking Rewards and Yields

Let’s talk about the moolah. Staking rewards and yields should be at the top of your list. Different spots give different rates, and it's all about the type of staking and the coins you're using. Platforms like Lido Staking and Rocket Pool are known for their juicy returns with their liquid staking options. Liquid staking is the bee’s knees because it lets you earn some dough while still keeping your assets in play for more DeFi action.

Type of Staking

Now, not all staking is the same. Here's the lowdown:

Proof-of-Stake (PoS) Staking: Locking up your coins to help verify transactions on the blockchain.

Yield Farming: Think of it like renting out your coins to DeFi projects and reaping the benefits.

Liquidity Mining: Providing some dough to platforms to keep things running smoothly.

Governance Staking: Earn by having a say in protocol decisions.

DAO Staking: Go all-in on a Decentralized Autonomous Organization.

Cold Staking: Keep it secure by staking from a hardware wallet.

Staking-as-a-Service (SaaS): Let platforms handle the hard part so you can just sit back.

Platform Security

Safety first, folks. Always go for platforms with solid security. Check for audits, bug bounties, and community trust to ensure your assets are in good hands.

Fees and Costs

Nobody likes hidden fees. Be sure to dig into staking fees, withdrawal fees, and any other charges that might sneak up on you. Transparent fees mean less headache later on.

Flexibility and Liquidity

You want to be able to move freely, right? Liquid staking platforms like Lido Staking and Rocket Pool provide that flexibility, leaving the door open for more trading and lending activities.

Supported Assets

Make sure the platform has room for the coins you want to stake. Diversifying can help save your bacon and maybe even pump up your earnings.

Restaking Options

Some platforms like EigenLayer go the extra mile, letting you restake your tokens. It's like getting extra lives in a video game—more chances to earn and engage.

User Experience

A slick interface with spot-on customer support can make your life a whole lot easier. If the platform is user-friendly, you won’t feel like ripping your hair out.

Historical Performance and Reputation

Do your homework! Check how the platform has performed in the past, and what others are saying about it. Positive vibes and consistency are great indicators of a reliable platform.

Top DeFi Staking Platforms in 2025

Rocket Pool

Rocket Pool's all about letting you earn from your ETH in a more relaxed style, kinda like having your cake and eating it too! You can jump into liquid staking and rack up rETH tokens, which are like loyalty points you can spend elsewhere in DeFi. Or, if you're feeling ambitious, run a node and grab ETH, plus RPL tokens and commissions.

Lido

Lido's the go-to if you love the flexibility without losing your spot in the staking game. It turns your ETH into stETH, which you can use just like regular ETH for all your rewarding escapades. The catch? A 10% fee gets sliced off, going to Lido DAO and its team.

Everstake

Everstake is like a buffet of crypto staking, catering to all your coin fantasies. It's user-friendly and lays out all the data you need to manage your staked goodies.

Lara Protocol

Lara Protocol shakes things up by letting you dive into staking and still play around in the DeFi sandbox. It's hooked up to lots of networks to help you squeeze the most out of your assets.

EigenLayer

EigenLayer is the safe bet with a fancy touch on yields. You can plow your rewards back into the DeFi fields for some sweet compounding action.

Pendle

Pendle’s got this novel vibe with its staking game, splitting yields from the original assets so you can trade like a pro. It’s all about juicing up those returns.

Ethena

Ethena’s like your personal crypto-smith, crafting flexible lock-ups and tweaking yields based on what you need, keeping things crystal clear with metrics.

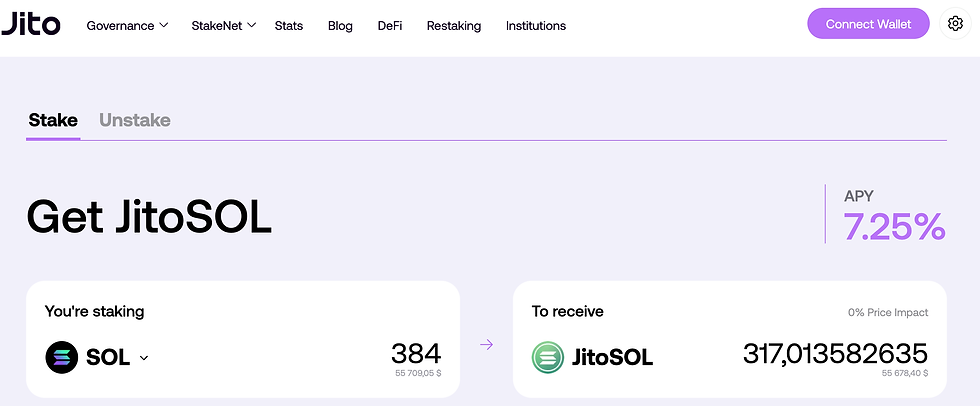

Jito

Jito's here to make your rewards sing with some algorithm magic and smart re-investments. It covers a range of assets, offering fancy tools to boost your play.

AQRU

AQRU rolls out the welcome mat for everyday folks looking for steady DeFi returns of 7% to 12%, depending on the coin.

Babylon

Babylon opens up options on big names like OKX, Binance, and Kucoin. Throw in some crypto and chill while rewards in local tokens keep stacking up.

Nexo

Based in London since 2018, Nexo’s a flexible friend with interest-earning options on over 50 cryptos, boasting tempting rates up to 16% APY.

These platforms make 2025 an exciting year for DeFi staking, letting investors sit back and earn while fine-tuning their crypto game for top returns. Each offers something unique, ready to suit whatever you're looking for in the crypto world.

Conclusion

Jumping into the best DeFi staking spots in 2025 is like finding a treasure chest on a beach - loads of scatterings, but when you find the right one, it's pure gold. From Rocket Pool to Lido Staking, and new faces like EigenLayer and Ethena, crypto fans and those on the hunt for juicy returns have plenty to pick from to amp up their crypto gig.

Staking rewards? They're the bread and butter for blockchain networks that use Proof of Stake (PoS) – think of them as the muscle keeping the network safe while filling up your pockets with passive dough. Look forward to growing adoption from the big wigs, beefed-up security, and zingy token structures, setting up a playground for both pros and newbies in the DeFi scene.

Poking around platforms like Everstake, Pendle Finance, and Nexo can dish out various ways to boost yield while suiting different risk appetites and picks. And keep an eye on innovative tricks like EigenLayer's "restaking" shenanigans, reflecting the growing flair in DeFi staking towards more intricate and rewarding setups.

For those chasing a solid staking mix, think of things like how safe a platform is, how pleasant it is to use, and the nuts and bolts of how each platform pays out. Savvy decisions pave the way for navigating the wild ride of DeFi staking and cranking up those crypto gains in 2025.

Fast Facts

Over $130B in assets are currently locked in DeFi staking protocols globally.

Ethereum, Solana, and Cosmos are the top three PoS chains by staking volume.

Average staking APY in DeFi ranges from 4% to 20%, depending on platform and asset.

Liquid staking accounts for 45% of all ETH staked in 2025.

Slashing incidents decreased by 30% YoY due to improved validator infrastructure.

FAQ

What is DeFi staking?

DeFi staking is the process of locking your crypto assets into a decentralized protocol to earn rewards, typically on a Proof-of-Stake blockchain.

What are the risks of DeFi staking?

Risks include smart contract bugs, validator slashing, market volatility, and project failure (rug pulls).

Can staking replace other investment strategies?

Staking's like the sidekick to your main investment hero. It’s great for bringing in some extra cash with minimal hassle, but putting all your financial eggs in one basket could be risky. Diversifying is key — spread the love across various investments for the best shot at success.

Is liquid staking better than traditional staking?

Liquid staking allows users to maintain liquidity while earning rewards, often enabling additional yield strategies. However, it may involve more risk due to reliance on smart contracts.

How much can I earn from DeFi staking in 2025?

APYs vary based on the asset and platform. On average, expect 4–10% for ETH, and up to 20%+ on emerging PoS chains.

Comments