3 Base Tokens Poised for Action After Coinbase Rolls Out DEX Integration

- Slava Jefremov

- Aug 12

- 3 min read

Introduction

In a significant move for decentralized finance adoption, U.S. crypto exchange Coinbase announced on Friday that it has launched decentralized exchange (DEX) trading integration. This update allows Coinbase users to directly buy and sell digital assets that were previously out of reach on the centralized platform.

The news comes during a broader market upswing seen this week, boosting investor sentiment across multiple ecosystems. The Base network—Coinbase’s Ethereum Layer-2 solution—has seen notable gains in several of its key tokens. Below, we explore three Base tokens gaining momentum amid this development: AERO, ZORA, and SKI.

Key Takeaways

Coinbase’s DEX integration has expanded trading access and triggered strong price moves across Base ecosystem tokens.

AERO surged 36% weekly with bullish Chaikin Money Flow (CMF) readings.

ZORA trades well above its 20-day EMA, showing strong short-term momentum.

SKI posted over 50% weekly gains, supported by soaring trading volumes.

Aerodrome Finance (AERO)

AERO, the native token of automated market maker Aerodrome Finance, has emerged as one of the top Base tokens to watch. At the time of writing, AERO trades at $1.06, up nearly 20% in the past 24 hours, extending its weekly gain to 36%.

On the AERO/USD daily chart, the CMF currently sits at 0.13 and is trending upward. A positive CMF indicates buy-side pressure, meaning traders are actively accumulating the asset. This often translates to prices closing in the upper range of their trading sessions—an indicator of bullish sentiment.

If this upward momentum continues, AERO could break above $1.0852 and potentially rally toward $1.3246.

However, if buying interest fades, the token’s price may retrace toward $0.7443.

ZORA

ZORA has been one of the standout performers this week, rallying 51% over the past seven days. Currently priced at $0.0904, the token shows signs of sustaining its bullish momentum.

On the daily chart, ZORA’s price trades well above its 20-day exponential moving average (EMA), which acts as dynamic support at $0.0630. The EMA assigns greater weight to recent prices, making it an effective tool for tracking short-term market sentiment.

When an asset’s price holds above its EMA, it often reflects buyer dominance in the market. If this momentum persists, ZORA could reach $0.1050.

However, a dip in demand might send the price down to $0.0843.

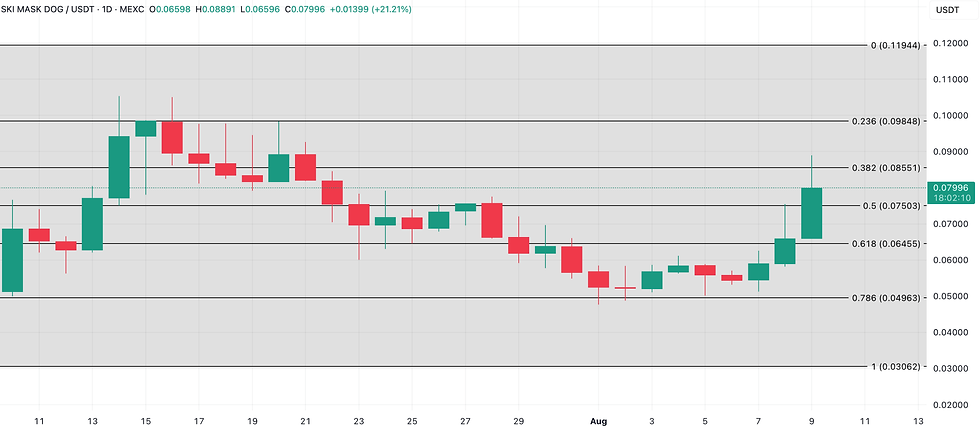

Ski Mask Dog (SKI)

The meme coin SKI has also joined the rally. At press time, SKI trades at $0.0799, posting a massive 52% gain in just one week. Over the past 24 hours alone, SKI has climbed 36%, ranking it among the best-performing Base tokens.

During the same period, trading volume jumped 119%, indicating that the price surge is backed by genuine market demand rather than speculative spikes alone. When both price and trading volume increase together, it signals strong conviction from buyers.

If current buying interest remains steady, SKI could push up to $0.0855.

On the flip side, profit-taking could drag the price back to $0.0750.

Conclusion

Coinbase’s integration of DEX trading marks an important milestone for the Base ecosystem, providing traders with access to a broader set of digital assets while fueling strong upward moves in select tokens. AERO, ZORA, and SKI have each shown robust technical signals and investor interest over the past week, positioning them as tokens to watch closely in the short term.

That said, traders should remain aware of the volatility inherent in crypto markets. While current momentum points upward, a sudden shift in sentiment or demand could quickly reverse gains. As always, strategic risk management remains essential.

Frequently Asked Questions

What is Coinbase’s DEX integration?

Coinbase’s new feature allows users to trade tokens directly through decentralized exchanges without leaving the Coinbase platform. This grants access to a wider range of assets previously unavailable on the centralized exchange.

Why are Base tokens rallying after the DEX announcement?

The integration boosts market accessibility and liquidity for Base ecosystem tokens, attracting new buyers and increasing demand.

What is the CMF indicator and why does it matter for AERO?

The Chaikin Money Flow (CMF) measures the volume-weighted average of accumulation and distribution over a set period. A positive CMF suggests buying pressure, often preceding continued price growth.

What does it mean for a token to trade above its EMA?

When a token’s price is above its exponential moving average, it generally reflects short-term bullish momentum and market control by buyers.

Are these tokens a safe investment?

While AERO, ZORA, and SKI show bullish trends, cryptocurrency investments carry high risk due to volatility. Always conduct thorough research and use appropriate risk management strategies.

Comments