What Is Crypto Spoofing?

- Slava Jefremov

- Aug 21, 2025

- 5 min read

Updated: Dec 9, 2025

Key Takeaways

Crypto spoofing is a manipulation tactic involving fake buy or sell orders to mislead traders.

Spoofers exploit emotions and volatility, creating artificial demand or panic to profit.

It is illegal under regulations such as the Dodd-Frank Act (U.S.) and enforced by agencies like the CFTC and FCA.

April 2025 saw a $212M Bitcoin spoof order on Binance, proving that manipulation still affects even top exchanges.

Layer spoofing is a more advanced form, spreading fake orders across multiple price levels.

Investors can protect themselves by trading on regulated exchanges, verifying market signals, and using limit orders.

Introduction

Cryptocurrency markets are notoriously volatile, fast-moving, and often unpredictable. This environment has made them a breeding ground for both innovation and manipulation. One of the most deceptive practices affecting traders today is crypto spoofing, a tactic where individuals or groups place fake buy or sell orders to manipulate market sentiment and influence price direction.

Although spoofing is strictly prohibited in traditional financial markets, it remains a pressing issue within digital asset trading, particularly on offshore or lightly regulated exchanges. Understanding how spoofing works, why it’s used, and how investors can protect themselves is essential for navigating crypto safely.

What Is Crypto Spoofing?

Crypto spoofing is a market manipulation strategy in which traders deliberately place large, fake buy or sell orders they never intend to execute. The purpose is to create a false impression of demand or supply, tricking other traders and automated bots into reacting in ways that benefit the spoofer.

Imagine this scenario: A trader places a massive Bitcoin (BTC) buy order worth $112,950, creating the illusion of overwhelming demand. Other traders, assuming the price will surge, rush to buy in. As soon as the price starts climbing, the spoofer cancels the fake order and sells their holdings at the inflated rate, profiting from the artificial move.

The spoofer never intended to purchase Bitcoin at that price. Instead, the order was designed purely to mislead. By fabricating bullish or bearish sentiment, spoofers can shift market dynamics in their favor—at the expense of genuine investors.

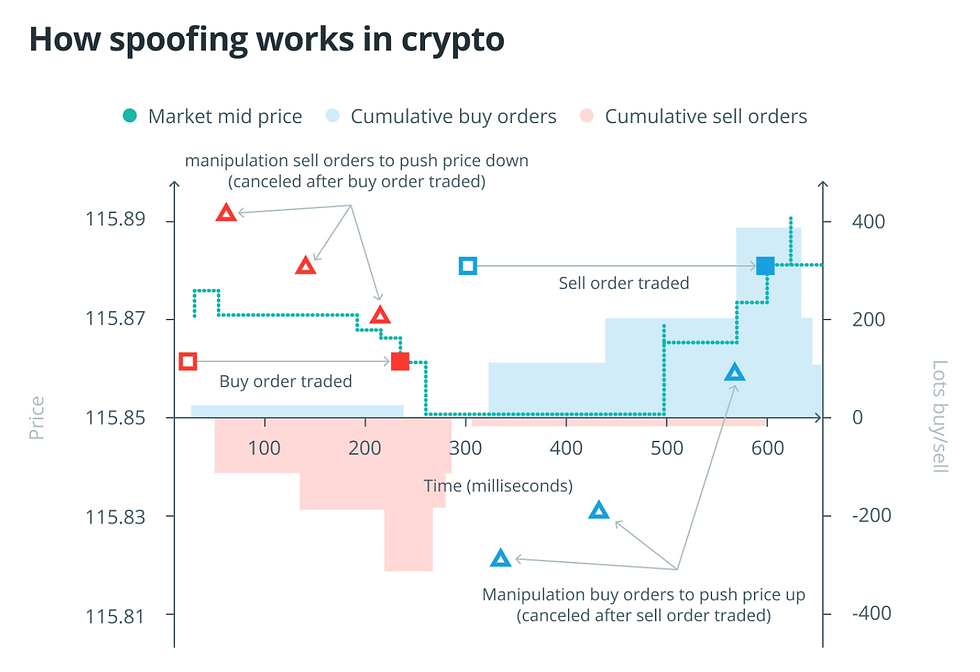

How Spoofing Works in Crypto

Crypto spoofing exploits two key aspects of digital asset trading: emotional investing and ultra-fast market fluctuations.

Because cryptocurrencies are highly volatile, even minor order book signals can influence traders within seconds. Spoofers use this sensitivity to their advantage:

Fake Buy Orders (Bullish Pressure): By stacking the order book with large buy walls, spoofers trick traders into believing demand is strong, driving prices upward. Once prices climb, the spoofer cancels orders and sells high.

Fake Sell Orders (Bearish Pressure): By placing large sell walls, spoofers spark panic, pushing prices downward. After the drop, they cancel orders and buy cheap.

This manipulation thrives in markets dominated by FOMO (fear of missing out) and FUD (fear, uncertainty, doubt). Automated trading bots are especially vulnerable since they instantly react to large orders without questioning their legitimacy.

Spoofing is often confused with maximal extractable value (MEV), but the two are distinct. MEV occurs when miners or validators reorder blockchain transactions to gain profit (via frontrunning or sandwich attacks). Spoofing, by contrast, happens directly in the order book, tricking traders and bots with fake liquidity.

Left unchecked, spoofing can fuel extreme volatility, trigger more manipulative behavior, and undermine trust in crypto markets.

Is Crypto Spoofing Legal?

In most jurisdictions, spoofing is considered illegal market manipulation.

United States: Under the Dodd-Frank Act of 2010, spoofing is a federal crime. The Commodity Futures Trading Commission (CFTC) monitors illegal crypto trading tactics and can impose penalties of up to 10 years in prison per violation. The Securities and Exchange Commission (SEC) also enforces anti-manipulation laws.

United Kingdom: The Financial Conduct Authority (FCA) applies similar restrictions, aiming to preserve market integrity.

Exchanges: Major platforms have begun deploying real-time detection systems, though offshore and unregulated exchanges still struggle to enforce strict oversight.

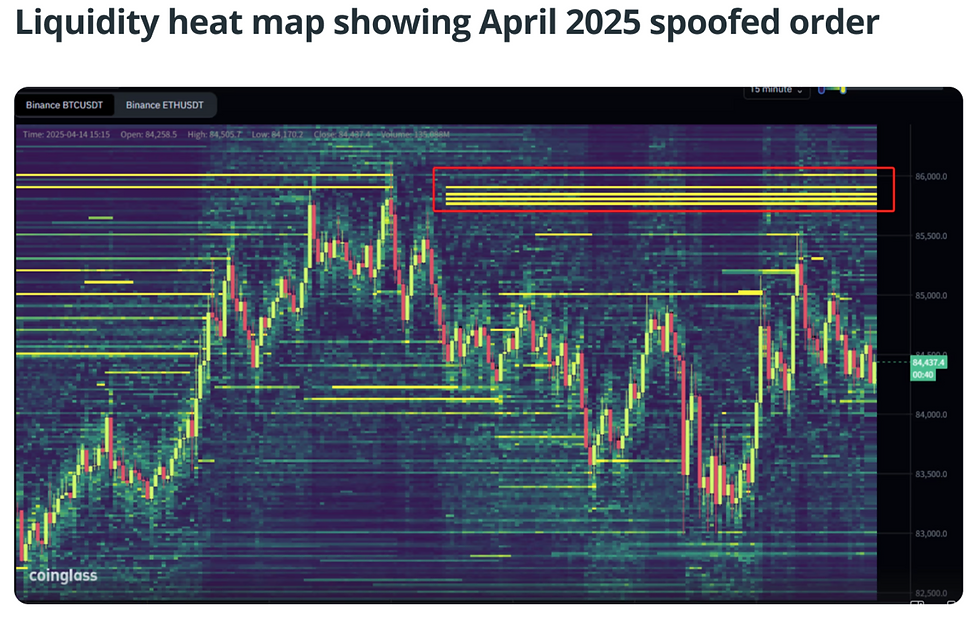

Despite regulations, spoofing remains widespread. For example, in April 2025, traders witnessed a $212-million Bitcoin sell order on Binance at $85,600, far above the market rate. The order vanished moments later, sparking panic and triggering sharp short-term volatility.

Reports from Q1 2025 indicate that manipulation persists on major platforms such as Binance, MEXC, and Hyperliquid, highlighting the ongoing regulatory challenges.

How to Detect Crypto Spoofing

Catching spoofers in real time is difficult. Detection requires careful monitoring of order books, unusual trading behavior, and patterns of cancellation. While no method is foolproof, traders can look for the following warning signs:

Sudden Order Book Changes: Large orders appearing at key support/resistance levels, only to vanish quickly, suggest false demand or supply.

Frequent Order Cancellations: A high volume of large orders placed and canceled repeatedly, without execution, can point to manipulation.

Liquidity Map Fluctuations: Heat maps showing sudden walls of liquidity that disappear during price moves often signal spoofing.

Unexplained Price Swings: Sharp volume spikes or price shifts not supported by news or fundamentals may be artificially engineered.

Persistent spoofing undermines confidence in exchanges, discouraging long-term participation. While regulators like the CFTC and FCA take enforcement measures, smaller exchanges with weaker KYC policies remain hotbeds for such manipulation.

What Is Layer Spoofing?

Layer spoofing is an advanced form of manipulation where a trader places multiple fake buy or sell orders at different price levels. Unlike a single large order, this creates a more convincing illusion of strong demand or supply.

For instance, several stacked orders spread evenly across the order book may appear legitimate. However, once the market price approaches these levels, they disappear instantly—revealing the manipulation.

This makes layer spoofing harder to detect, but liquidity maps and order flow analysis can help reveal suspicious patterns.

How Can Investors Protect Themselves Against Spoofing?

While spoofing is hard to eliminate completely, investors can reduce their risk by adopting cautious strategies:

Use Reputable, Regulated Exchanges: Platforms with strong compliance are more likely to enforce anti-manipulation measures.

Monitor Order Books Closely: Watch for large “phantom” orders that vanish quickly, signaling potential spoofing.

Cross-Verify Price Trends: Compare data across sources like CoinMarketCap and multiple exchanges to spot inconsistencies.

Trade Rationally with Limit Orders: Avoid emotional reactions. Use limit orders to control entry and exit points, protecting yourself during volatile swings.

Ultimately, awareness is key. If a signal looks too good to be true, it often is.

Conclusion

Crypto spoofing represents one of the most persistent manipulation challenges in digital asset markets. While regulators worldwide classify spoofing as illegal and exchanges are adopting detection tools, enforcement remains inconsistent—particularly on offshore platforms.

By understanding how spoofing works and practicing disciplined trading strategies, investors can reduce their exposure to manipulation. As the crypto industry matures, improved transparency and stronger oversight will be essential in protecting traders and building long-term confidence in digital markets.

Frequently Asked Questions (FAQ)

Is crypto spoofing the same as wash trading?

No. Spoofing involves fake orders that are canceled before execution, while wash trading involves executing trades with oneself to inflate volume artificially.

Can spoofers be prosecuted in crypto markets?

Yes. In the U.S., spoofing can lead to fines and up to 10 years in prison per violation under the Dodd-Frank Act. Other jurisdictions, like the UK, enforce similar penalties.

Why is spoofing still common despite being illegal?

Enforcement is difficult in global crypto markets, especially on unregulated exchanges where oversight is minimal.

How can I tell if a crypto order book is being spoofed?

Look for large orders that appear and vanish rapidly, unusual cancellation patterns, or sudden liquidity walls that disappear when the market approaches them.

What should I do if I suspect spoofing on an exchange?

Avoid reacting impulsively. Use limit orders, verify signals across multiple platforms, and, if possible, report suspicious activity to the exchange or regulators.

Comments