What Ether ETF Inflows Mean For Traders?

- Slava Jefremov

- Oct 2

- 5 min read

Updated: 1 day ago

Key Takeaways

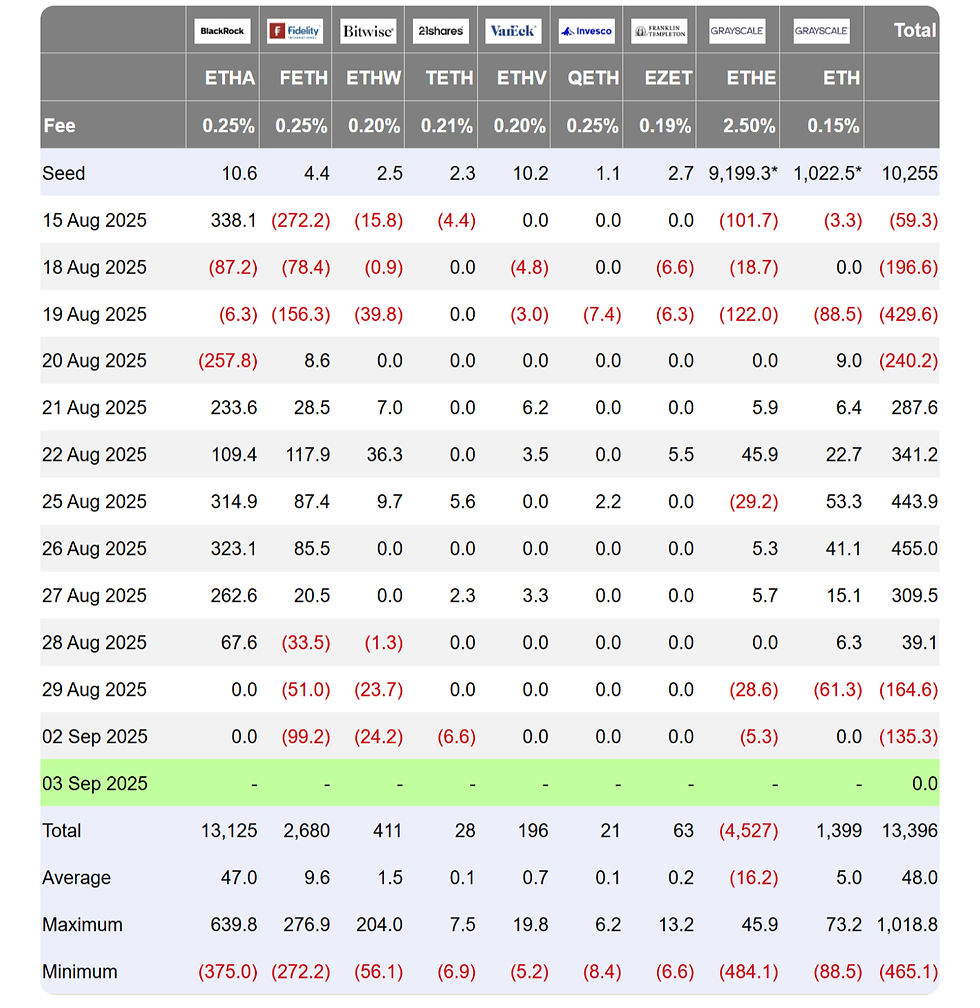

Ether ETFs attracted $3.87 billion in inflows in August 2025, while Bitcoin ETFs saw $751 million in outflows, highlighting diverging investor sentiment.

Spot Ether ETFs now hold approximately $28.8 billion, or about 5.3% of ETH’s total market capitalization.

Record-breaking inflows, including $1.02 billion in a single day, have coincided with ETH approaching the $5,000 level.

ETF inflows act as a market signal for institutional sentiment, liquidity dynamics, and short-term price action.

Long-term adoption is accelerating, with corporate treasuries and financial institutions integrating ETH into their strategies.

Traders must remain mindful of regulatory risks, Bitcoin competition, ETF dependency, and early-phase volatility.

Introduction

The cryptocurrency market in 2025 continues to evolve rapidly, with institutional adoption shaping price action and long-term sentiment. While Bitcoin has long been the primary gateway for institutions, Ether is stepping into the spotlight with the rise of spot exchange-traded funds (ETFs). These investment vehicles have unlocked unprecedented access to ETH for traditional investors, reshaping the competitive landscape between the two leading digital assets.

August 2025 marked a turning point: Ether ETFs captured billions in inflows while Bitcoin ETFs recorded substantial outflows, signaling a potential shift in institutional preferences. For traders, understanding these inflows is not just about numbers but about reading the signals that influence both short-term volatility and long-term market structure.

The Rise of Ether ETFs

Ether has consistently stood out as more than just a cryptocurrency. At $4,376 per token in 2025, ETH remains the foundation for decentralized finance (DeFi), non-fungible tokens (NFTs), and smart contracts. Unlike Bitcoin, priced at $118,617, which primarily serves as a store of value, Ether offers real-world utility across multiple financial applications.

The emergence of spot Ether ETFs in 2025 provided institutional investors with a regulated entry point into ETH without the complexities of custody and storage. According to SoSoValue, these funds attracted $3.87 billion in net inflows in August 2025, while Bitcoin ETFs lost $751 million during the same period.

This contrast has fueled speculation about the long-discussed flippening, where Ether could one day rival Bitcoin’s dominance.

What Are Ether ETFs and Inflows?

Before analyzing implications, it is important to understand what Ether ETFs are and why inflows matter.

What it is: An Ether ETF is an exchange-traded fund that allows investors to gain exposure to ETH without directly holding it.

Spot ETF vs. Futures ETF: Spot ETFs hold Ether directly, while futures ETFs track ETH futures contracts.

Inflows: Net money entering ETFs. Positive inflows indicate demand and institutional confidence; outflows suggest selling pressure.

Recent data illustrates the scale of the market:

BlackRock’s ETHA ETF holds about $16 billion in assets.

Grayscale’s ETHE manages $4.6 billion.

Fidelity’s FETH controls around $3.5 billion.

Combined, Ether ETFs represent $28.8 billion, or 5.3% of Ether’s market cap.

For comparison, Bitcoin ETFs remain larger, led by BlackRock’s IBIT with roughly $82 billion. Yet the momentum behind Ether is increasingly difficult to ignore.

Ether Inflows as a Market Signal

ETF inflows reveal how institutions are positioning themselves, and traders should pay close attention to these figures.

Why inflows matter for traders:

Institutional sentiment: Hedge funds, pension funds, and asset managers allocating to ETH demonstrate growing confidence.

Liquidity dynamics: As ETF demand rises, ETH supply on exchanges shrinks, creating upward price pressure.

Historical parallels: In 2021, crypto ETFs attracted $7.6 billion in inflows, helping drive Bitcoin to record highs.

Recent examples highlight the impact:

On July 16, 2025, Ether ETFs recorded $726.6 million in inflows in one day, pushing ETH to test $5,000.

In late August 2025, US spot Ether ETFs logged $729 million in daily inflows, followed days later by a record $1.02 billion. Over just three days, inflows totaled $2.3 billion, driving cumulative inflows to $12.1 billion.

For traders, monitoring inflows on platforms such as SoSoValue, CoinShares, and Farside Investors offers an edge in anticipating potential price moves.

How Ether ETF Inflows Shape Short-Term Price Action

Large ETF inflows reduce available ETH on exchanges, creating upward price pressure. However, this also amplifies volatility as traders react.

Short-term impacts include:

Price momentum: ETH rose more than 40% in July 2025, partly fueled by ETF inflows.

Volatility: ETH dropped 4% in 24 hours after failing to hold $5,000 despite strong inflows.

Options market impact: Rising inflows boost implied volatility, creating opportunities for options traders.

Arbitrage: Discrepancies between ETF shares and spot ETH markets open arbitrage plays.

Strategies to monitor:

Momentum trading during inflow surges.

Hedging with futures or options when inflows peak.

Watching ETH reserves on exchanges for early signals of supply squeezes.

Short-term traders can profit from inflow-driven volatility but must maintain strict risk management to avoid being caught in sudden reversals.

Ether ETFs and Long-Term Institutional Integration

Beyond daily volatility, Ether ETFs signal deeper institutional adoption. This trend has implications for ETH’s role as a global financial asset.

Corporate adoption is growing:

SharpLink Gaming added 800,000+ ETH to its balance sheet.

ETHZilla increased reserves to 102,000 ETH.

BitMine Immersion Tech holds 1.8 million ETH, the largest publicly traded ETH treasury.

Institutional sentiment is shifting:

VanEck CEO Jan van Eck described ETH as “the Wall Street token,” emphasizing its role in stablecoin transfersand financial infrastructure.

ETFs now represent over 5% of ETH’s total market cap, signaling mainstream integration.

Long-term benefits could include:

Greater liquidity and potentially reduced volatility.

Demand from pension funds, family offices, and insurance firms.

Deeper integration into traditional finance, especially if staking features gain regulatory approval by late 2025.

Ether’s combination of financial utility and technological innovation makes it a compelling candidate for sustained institutional investment.

Key Risks and Challenges for Traders

Regulatory Uncertainty

The GENIUS Act and CLARITY Act aim to provide clearer rules, but regulatory shifts remain unpredictable.

The SEC could impose restrictions on ETF approvals, staking, or compliance, reducing demand.

Competition with Bitcoin ETFs

Bitcoin ETFs still dominate with over $100 billion in assets, led by IBIT’s $82 billion.

While ETH ETFs are growing, Bitcoin remains the benchmark institutional asset.

Over-Reliance on ETFs

Strong inflows create bullish narratives, but outflows can trigger sharp declines.

Traders should also watch exchange reserves, macro trends, and technical signals.

Volatility in Early Phases

As with early Bitcoin ETFs, Ether ETFs may bring heightened turbulence.

Price swings above 10% remain possible, requiring disciplined stop-losses and hedging strategies.

Conclusion

The rise of Ether ETFs in 2025 represents more than just a new investment product. With $28.8 billion in assets and record-breaking inflows, ETH is solidifying its place as a core institutional asset. For traders, these inflows act as critical market signals that influence both short-term volatility and long-term adoption trends.

Yet risks remain. Regulatory uncertainty, Bitcoin’s continued dominance, and the inherent volatility of early ETF phases demand cautious strategies. The opportunity is clear, but so is the need for disciplined risk management. For those who can read and react to institutional flows, Ether ETFs may provide some of the most powerful trading signals in today’s crypto market.

Frequently Asked Questions

What is the difference between a spot Ether ETF and a futures ETF?

A spot Ether ETF holds ETH directly, while a futures ETF tracks contracts based on ETH prices. Spot ETFs typically have a more direct impact on ETH’s supply and demand dynamics.

Why are inflows into Ether ETFs important for traders?

Inflows indicate rising institutional demand and reduced available ETH on exchanges, which can drive prices higher. Monitoring inflows provides early signals of potential momentum shifts.

How large are Ether ETFs compared to Bitcoin ETFs?

Ether ETFs currently hold $28.8 billion, or about 5.3% of ETH’s market cap, while Bitcoin ETFs are much larger with over $100 billion in assets.

Can ETF inflows guarantee higher ETH prices?

Not necessarily. While inflows often create bullish momentum, prices can still fall due to volatility, profit-taking, or macroeconomic factors.

What risks should traders consider when using ETF inflows as signals?

Key risks include regulatory uncertainty, competition with Bitcoin ETFs, dependency on inflows for bullish sentiment, and early-phase volatility. Traders should use ETF data alongside other indicators for balanced strategies.

Comments