Smarter Crypto Research With Google Gemini: A Practical Investor’s Playbook

- Slava Jefremov

- Oct 8

- 5 min read

Key Takeaways

Gemini is a research assistant for summarizing data and analyzing text, not a financial adviser for predicting prices.

The quality of your research output depends entirely on the specificity and structure of your prompts.

A repeatable workflow involves deconstructing a project’s fundamentals, analyzing its economics and mapping its competitive landscape.

Always verify AI generated information with primary sources like official websites, white papers and blockchain explorers.

Proper setup and operational security are crucial, especially when using API keys to connect to external data.

Introduction

The cryptocurrency market can feel overwhelming. White papers, complex tokenomics and endless social chatter create a flood of information. The challenge for investors is not finding data, it is figuring out what actually matters. It filters noise into usable insight.

How to research a cryptocurrency with Gemini

Use a structured line of inquiry. Guide the model with precise, contextual instructions, treat it like a specialist, and aim for outputs that are directly actionable.

Assign a role

Start prompts with a directive like “Act as a senior blockchain analyst...” or “Act as a venture capital associate specializing in decentralized finance...” to frame context. This nudges the model to simulate domain expertise.

Request a format

Specify the output structure. Ask Gemini to “Create a comparison matrix in a markdown table” or to “Draft a SWOT analysis of this project” so the information is easier to digest and compare.

Iterate and refine

Treat the first response as a starting point. If it lists competitors, a useful follow up is, “Based on the competitive analysis you just provided, what is the single most significant defensible moat for this project?” Iteration builds depth.

Part 1: Deconstructing the project’s fundamentals

Begin with the project’s design. Deconstruct core technology, identify incentives that govern the native token and investigate the team. Consider Solana, a performance layer 1 built for decentralized applications and Web3.

Analyzing the white paper and technology

Reading dense documentation can take hours. A Gemini assisted approach is efficient. Try:

“Act as a blockchain engineer. In no more than 5 concise bullet points, summarize the Solana white paper with emphasis on its Proof of History plus Proof of Stake consensus mechanism. Highlight how it differs from traditional monolithic Layer 1 blockchains.”

Dissecting tokenomics

The economic model of a token is critical for long term viability. Gemini can surface potential red flags, such as aggressive vesting schedules or a lack of utility. Use:

“Act as a blockchain tokenomics analyst. Provide a concise analysis (max 6 bullet points) of Solana (SOL) token. Summarize token allocation (team, private and seed or strategic investors, community, foundation), outline vesting schedules and unlock timelines, highlight value accrual mechanisms (staking, inflation, fee burns), and estimate the initial circulating supply based on these data.”

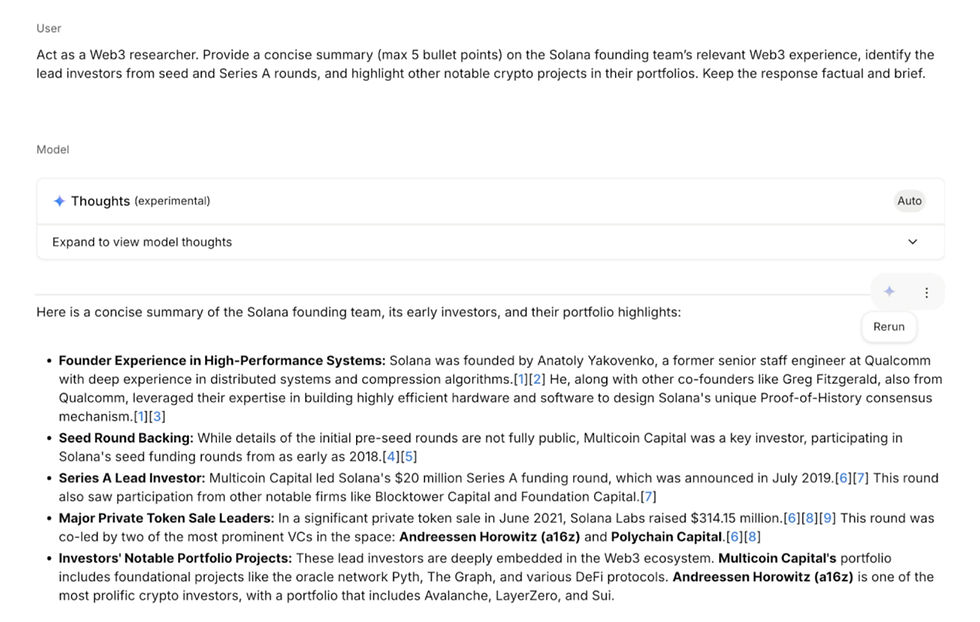

Scrutinizing the team and backers

Leadership and funding history are trust signals. Prompt:

“Act as a Web3 researcher. Provide a concise summary (max 5 bullet points) on the Solana founding team’s relevant Web3 experience, identify the lead investors from seed and Series A rounds and highlight other notable crypto projects in their portfolios. Keep the response factual and brief.”

Part 2: Mapping the competitive landscape and social sentiment

Projects do not operate in a vacuum. Success depends on position within the market and the sentiment of the community. After establishing fundamentals, assess these external factors.

Competitive landscape analysis

Understanding how a project stacks up against rivals is essential. Ask:

“Act as a market intelligence analyst. Identify the top three competitors to the Ethereum Chain. Create a feature comparison matrix, evaluating them on transaction finality, developer ecosystem support, and network activity as of Q3 2025.”

Gauging market sentiment

The crypto market is heavily influenced by narrative and social discourse. After a successful testnet launch by Solana in September 2025, an investor would want to understand the market’s reaction. Use:

“Analyze the public sentiment on X and crypto focused subreddits regarding Solana’s most recent testnet deployment. Identify the main positive narratives being discussed, the key concerns raising criticism, and list 3 to 5 influential accounts driving the conversation.”

Part 3: Conducting advanced risk analysis

With fundamentals and positioning understood, analyze risk and governance to complete an investment thesis. Gemini can accelerate this work by summarizing complex but often overlooked documentation.

Analyzing security audits

Smart contract and protocol security matter. Rather than parsing a dense audit report, ask Gemini for the executive summary:

“Summarize the key findings from the security audit report for Solana conducted by [Reputable Audit Firm]. List any high severity vulnerabilities identified and confirm whether the report states they were successfully remediated.”

Evaluating regulatory headwinds

Regulation is a constant and significant risk. Gemini can synthesize information on this front:

“Based on global regulatory trends as of September 2025, analyze the potential regulatory risks for a project offering decentralized off chain computation (similar to Solana). Focus on securities law and data privacy implications in major jurisdictions. Keep the answer in max 5 concise bullet points.”

Understanding governance

For projects with decentralized governance, understand the mechanics. Prompt:

“Explain the on chain governance model of Solana. Detail the proposal submission process, the token weighted voting mechanism, and the quorum threshold required for proposals to be enacted. Keep the response concise and structured in no more than 5 bullet points.”

Conclusion

Gemini is a tool for augmentation, not an infallible source of truth. Large language models can generate plausible but incorrect information. Therefore, the final and most important step in any AI assisted research process is independent verification.

Treat Gemini’s output as a highly organized first draft. Critical data points, such as token allocation percentages or partnership announcements, must be cross referenced with primary sources like the official project website, white paper, audit reports, press releases or a blockchain explorer. The advantage comes from the synergy between machine scale processing and human critical thinking. Find our Google Gemini crypto research useful? Read how to turn crypto news intro trade signals with Google Gemini too.

FAQs

Is Gemini able to predict coin prices?

No. Gemini can summarize data and analyze text, yet it cannot reliably forecast asset prices or guarantee returns. Treat outputs as research scaffolding, not as trading signals.

How specific should my prompts be?

Be concrete about roles, sources, formats and constraints. Ask for bullet point summaries, matrices or SWOTs, and name the protocol, timeframe and metrics you care about.

Can I use Gemini with API keys for on chain data?

Yes, but handle secrets carefully. Use environment variables, scoped permissions and read only keys when possible. Rotate keys and avoid pasting secrets into shared chats.

What tokenomics details should I always confirm?

Check allocation among team, investors, community and foundation, the vesting or unlock schedule, staking or inflation parameters, fee burns, and the circulating supply at launch.

What primary sources should I trust for verification?

Rely on official websites, white papers, audit reports, press releases and blockchain explorers. Use social media as a lead generator, not as a source of truth.

Comments