Michael Saylor’s Bitcoin Strategy Explained

- Slava Jefremov

- Oct 3

- 5 min read

Updated: 5 days ago

Key Takeaways

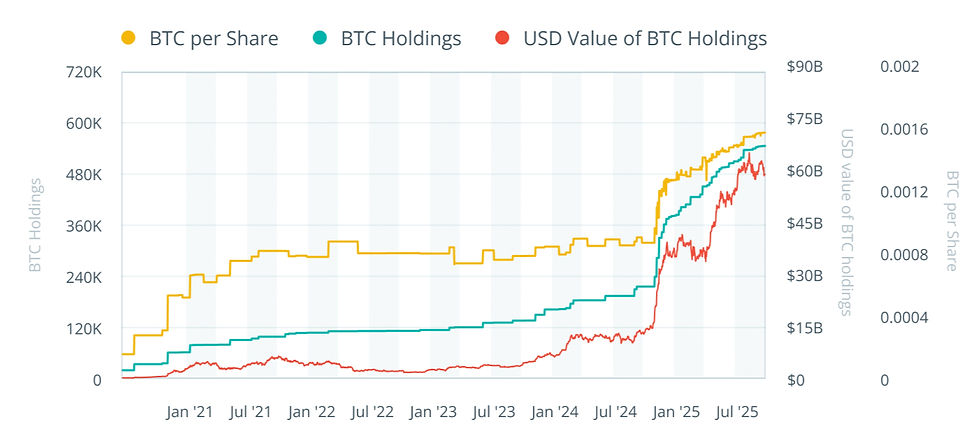

Strategy (formerly MicroStrategy) is the largest corporate holder of Bitcoin with 640,031 BTC worth over $73 billion as of September 2025.

The company’s average acquisition cost is $73,983 per coin, achieved through convertible debt, preferred stock, and equity raises.

Saylor believes Bitcoin is the optimal treasury asset, superior to cash and gold due to its scarcity, portability, and resilience.

His thesis: a 10% institutional allocation ($10–$12 trillion) could push Bitcoin toward $555,000–$750,000, with $1 million possible over time.

Risks include regulatory hurdles, shareholder dilution, and reliance on institutional adoption.

Introduction

Michael Saylor has emerged as one of the most influential figures in the cryptocurrency space. As the co-founder and executive chairman of Strategy (formerly MicroStrategy), Saylor has radically transformed how corporations think about their balance sheets. Since 2020, his company has aggressively accumulated Bitcoin, turning its corporate treasury into a digital asset vault unlike anything seen before in traditional finance.

By September 2025, Strategy had amassed 640,031 BTC worth over $73 billion, positioning the firm as the largest public corporate holder of Bitcoin. This accumulation is more than a bold investment — it reflects Saylor’s conviction that Bitcoin is the superior treasury asset for the modern era. His thesis is simple but revolutionary: if Wall Street allocates even 10% of its assets into Bitcoin, the price could rise toward $1 million per coin.

Below, we break down Saylor’s playbook, his financial maneuvers, the bold $1 million Bitcoin projection, and the risks and implications that come with this unprecedented corporate experiment.

Saylor’s Bitcoin Strategy

Michael Saylor’s goal is nothing less than redefining corporate treasuries. Since August 2020, Strategy has pursued an aggressive strategy of acquiring and holding Bitcoin. By September 2025, the firm’s 640,031 BTC holdings — roughly 3% of Bitcoin’s circulating supply — were valued at more than $73 billion, giving Strategy massive unrealized gains at current levels.

For Saylor, Bitcoin serves multiple functions. It is a hedge against inflation, a non-debasable reserve asset, and a way to front-run the institutional flows that he believes will inevitably arrive. His thesis has captured attention across global markets: if large asset managers and pension funds shift even 10% of their assets into Bitcoin, the price could accelerate toward the million-dollar mark.

Bitcoin as the Optimal Treasury Asset

Saylor’s corporate strategy is relentless: buy Bitcoin, hold indefinitely, and integrate it into the firm’s DNA. Since 2020, Strategy has funneled excess cash, debt financing, and equity issuance into regular BTC acquisitions.

The company’s average purchase price is about $73,983 per coin, reflecting a long-term conviction that volatility is an opportunity rather than a threat. To fund these purchases, Strategy has relied on a blend of zero- or low-coupon convertible notes, preferred stock, at-the-market equity offerings, and structured deals that minimize shareholder dilution.

For Saylor, Bitcoin outclasses every other treasury asset:

Compared to cash, which he describes as a “melting ice cube,” Bitcoin resists inflation thanks to its fixed supply cap of 21 million coins.

Compared to gold, Bitcoin is more efficient. Gold is costly to store and transport, while Bitcoin is borderless, digital, and secured by a decentralized network that is resistant to censorship.

Compared to traditional financial assets, Bitcoin has shown a weakening correlation with stocks and bonds, enhancing its appeal as a diversification tool during inflationary or loose monetary environments.

In Saylor’s view, Bitcoin is scarce, portable, resilient, and tailor-made for 2025 and beyond.

The Road to $1 Million: Breaking Down Saylor’s Projection

Saylor’s most ambitious forecast is that Bitcoin could reach $1 million per coin. This projection rests on institutional capital flows. Pension funds, insurers, mutual funds, and asset managers collectively oversee more than $100 trillion. If just 10% of that pool ($10–$12 trillion) were to shift into Bitcoin, the impact would be transformative.

With only 21 million BTC ever to exist, that level of demand would imply a valuation near $475,000 per coin. But Saylor argues the effective supply is much lower.

Between 2.3 million and 3.7 million BTC are believed lost forever.

“Ancient” supply (coins unmoved for more than seven years) plus corporate treasuries lock up another 24% of the total supply.

More than 72% of Bitcoin is classified as illiquid, held by entities with no selling history.

This means the true liquid supply may be only 16–18 million BTC. If the same $10–$12 trillion allocation were distributed across this smaller pool, the implied price rises to $555,000–$750,000 per coin.

Saylor suggests that with asset growth over time or allocations exceeding 10%, the million-dollar mark comes into focus. Still, he acknowledges that institutional adoption would be gradual, constrained by regulatory approval, liquidity, and internal risk committees.

How Strategy Finances Its Bitcoin Purchases

To fuel its Bitcoin buying spree, Strategy has leaned on a sophisticated mix of financing structures.

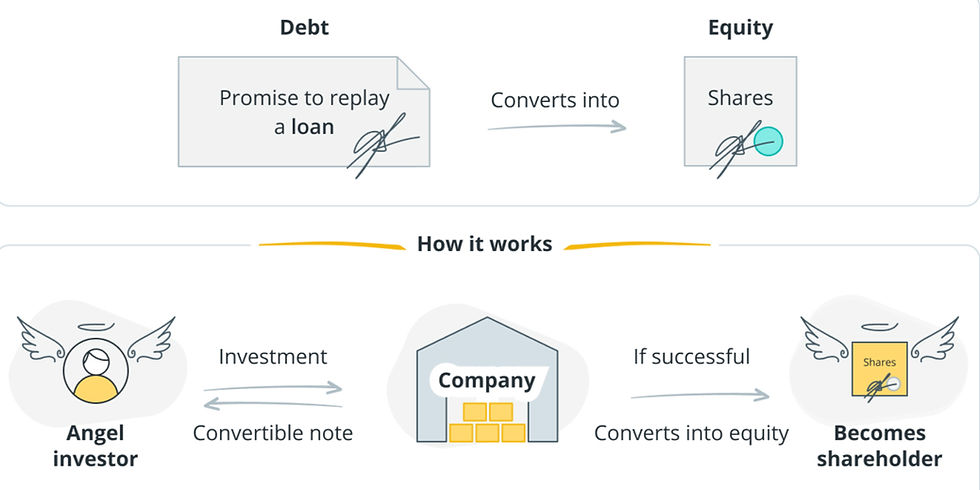

Convertible Senior Notes

Convertible senior notes are a central tool. These debt instruments often carry zero or minimal interest, with conversion features that defer shareholder dilution.

In mid-2024, Strategy raised $800 million (about $786 million net) via convertible notes at a 35% conversion premium, using the proceeds to acquire 11,931 BTC at an average of $65,883.

Shortly afterward, the firm closed another convertible deal worth approximately $600 million.

Preferred Stock and “Stretch” Offerings

In addition to debt, Strategy issues preferred stock. The company’s Stretch (STRC) preferred stock offers a variable dividend, starting near 9% annually, explicitly earmarked for Bitcoin purchases.

In July 2025, Strategy expanded a planned $500 million Stretch issuance to $2 billion, signaling strong investor demand.

Some insiders participated in a tranche paying 11.75%, highlighting appetite for yield-tied Bitcoin exposure.

Recent Purchases

In September 2025, Strategy announced the acquisition of 196 BTC at an average of $113,048, spending about $22 million. These purchases were financed through equity and preferred stock sales rather than operational income or liquidating existing BTC.

Risks, Criticisms, and the Road Ahead

Strategy’s bold experiment has elevated its profile, but it comes with clear trade-offs. The firm now behaves more like a leveraged Bitcoin ETF than a traditional software company. Its share price moves in lockstep with Bitcoin, and continued financing through equity, convertibles, and preferred stock creates dilution risks for existing shareholders.

Analysts highlight several concerns:

Regulatory risk: New tax or accounting standards could disrupt the corporate case for holding Bitcoin.

Opportunity cost: Billions are concentrated in one volatile asset.

Institutional demand uncertainty: The million-dollar thesis assumes that Wall Street adopts Bitcoin meaningfully.

Despite these risks, Strategy has accelerated Bitcoin’s integration into corporate finance. It has spurred growth in custody solutions, ETFs, and institutional over-the-counter markets.

Key developments to watch include:

Future capital raises and innovative financing structures.

Regulatory updates on accounting and taxation for Bitcoin.

Clear signals of large asset managers allocating assets into digital currency.

If these trends align, Saylor’s bet could reshape not only corporate treasury management but also Bitcoin’s role in global finance.

Conclusion

Michael Saylor’s Bitcoin strategy is one of the boldest experiments in modern finance. By converting Strategy’s balance sheet into a Bitcoin treasury, he has transformed a traditional software firm into a digital asset pioneer. His vision hinges on Bitcoin’s scarcity and its appeal as a superior form of money in a world grappling with inflation and monetary expansion.

The potential rewards are enormous. If institutions move even a fraction of their assets into Bitcoin, Saylor’s $1 million projection could materialize. Yet the risks are equally significant, with Strategy’s fortunes now tied almost entirely to one volatile asset.

What is clear is that Saylor has altered the conversation around corporate finance. Bitcoin is no longer a fringe experiment; it is a legitimate treasury option, and one that could redefine the balance sheets of the future.

Frequently Asked Questions

How much Bitcoin does Strategy hold?

As of September 2025, Strategy holds 640,031 BTC, valued at over $73 billion.

What is Strategy’s average Bitcoin purchase price?

The company’s average acquisition cost is about $73,983 per coin.

How does Strategy finance its Bitcoin purchases?

The firm primarily uses convertible senior notes, preferred stock issuances, and at-the-market equity offerings.

Why does Michael Saylor view Bitcoin as the best treasury asset?

Saylor believes Bitcoin’s fixed supply, digital portability, and resistance to debasement make it superior to cash, gold, and traditional financial assets.

What is Saylor’s Bitcoin price prediction?

He argues that if institutional investors allocate just 10% of their $100 trillion assets, Bitcoin could trade between $555,000 and $750,000, with a long-term possibility of reaching $1 million per coin.

What risks does Strategy face with this approach?

Risks include regulatory changes, shareholder dilution, concentration in a single volatile asset, and uncertainty around institutional adoption.

Comments