How to Rent an Apartment in Dubai with Bitcoin: Step-by-step Guide

- Slava Jefremov

- Aug 22

- 6 min read

Key Takeaways

Dubai’s regulatory clarity allows tenants to rent apartments with Bitcoin through licensed and approved channels.

Risks like volatility and landlord acceptance are mitigated through AED price locks, licensed intermediaries, and clear contract terms.

Fast settlement times and lower fees make Bitcoin an increasingly attractive option for real estate transactions in Dubai.

While Bitcoin price swings and limited landlord participation remain concerns, strong oversight by the Dubai Land Department (DLD), the Central Bank of the UAE (CBUAE), and the Virtual Assets Regulatory Authority (VARA) ensures compliance and transparency.

Introduction

Dubai has quickly become one of the world’s few real estate hubs where paying rent in cryptocurrency is not unusual.

By 2025, the emirate has solidified its reputation as a global leader in crypto adoption. The Dubai Land Department (DLD), the Central Bank of the UAE (CBUAE), and the Virtual Assets Regulatory Authority (VARA) have all introduced frameworks that provide clarity for crypto-based real estate payments.

VARA licenses digital asset service providers ranging from custodians to payment processors, while the DLD ensures all leases remain denominated in dirhams (AED). This means when tenants rent apartments in Dubai with Bitcoin, the funds are first converted into AED via VARA- or CBUAE-approved channels.

This structured oversight has transformed Bitcoin into a practical payment tool for housing, allowing both long-term residents and newcomers to settle rent efficiently while staying fully compliant with Anti-Money Laundering (AML) laws.

This guide walks you step-by-step through the process of paying rent with Bitcoin in Dubai, from understanding regulations to finding crypto-friendly landlords.

Crypto Rental Process in Dubai

By mid-2025, Dubai had established one of the most advanced regulatory structures for real estate crypto payments worldwide. VARA oversees crypto custodians, exchanges, and processors under its Asset-Referenced Virtual Assets regime.

The CBUAE strengthens this framework by requiring all stablecoin-based property payments to pass through licensed entities. From August 2025, full Know Your Customer (KYC) and AML checks will be mandatory for every crypto property payment.

Meanwhile, the DLD enforces AED-only recording of deeds and contracts. While this does not block Bitcoin use, it requires every transaction to pass through a licensed crypto-to-dirham conversion before the lease is officially registered.

Crypto real estate is still emerging but expanding rapidly. In early 2025, about 3% of off-plan property deals were completed using cryptocurrency, often by international investors seeking cheaper, faster transactions. That same infrastructure now enables tenants to rent apartments with Bitcoin.

Innovation is also accelerating. The DLD, VARA, and Dubai Future Foundation jointly launched Prypco Mint, a property tokenization platform built on the XRP Ledger. Its initial offerings sold out instantly, highlighting growing demand for crypto-based real estate solutions.

Together, AED deed requirements, VARA licensing, and tokenization platforms form a transparent pathway for Bitcoin to flow legally into Dubai’s housing market.

How to Rent an Apartment with Bitcoin in Dubai

1. Find Bitcoin-Friendly Landlords

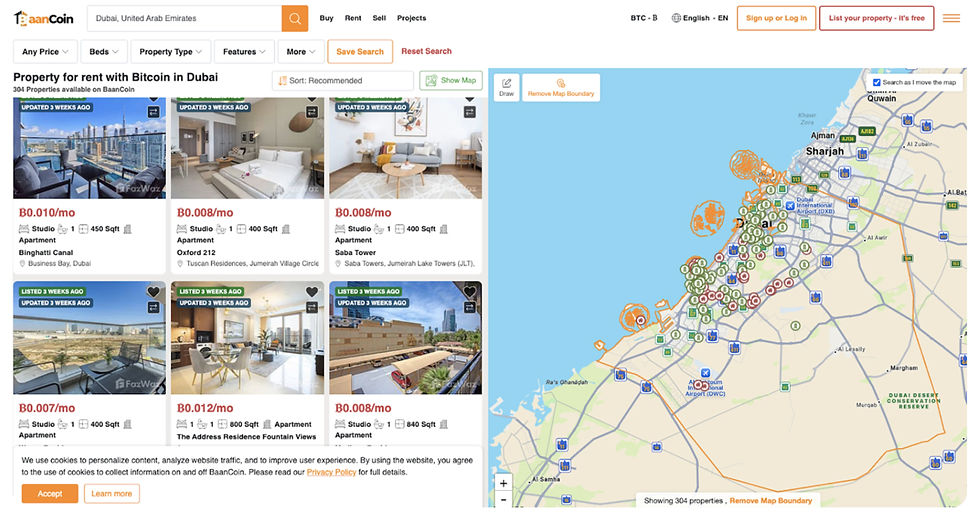

Search for landlords and listings that openly accept Bitcoin. Platforms like BaanCoin currently list more than 220 apartments in Dubai across Business Bay, Downtown, the Marina, and JVC. Monthly rents range from 0.007 BTC to 0.022 BTC, depending on the unit size and location.

Traditional real estate portals such as Bayut and Property Finder also offer DLD-verified listings, some of which include crypto-friendly agents. Use filters or “crypto-friendly” tags to quickly identify suitable options.

2. Work with Crypto-Specialized Agencies

Dedicated agencies simplify the process by managing both legal compliance and technical conversions.

Paragon Properties works with major developers like Emaar, Damac, and Nakheel, accepting Bitcoin, Ether, Tether USDt, and other assets.

Crypto Properties Agency, featured on Bayut, focuses exclusively on digital asset transactions in real estate.

These intermediaries streamline the rental experience and ensure tenants remain compliant.

3. Confirm Lease Terms with Landlord or Agent

Before committing, clarify details such as:

Rent amount in AED (must be dirham-denominated)

Conversion rate methodology and update frequency

Payment schedule (monthly or quarterly)

Refunds, late payment policies, and volatility handling

These must be explicitly written into the contract for smooth dispute resolution.

4. Use Licensed Payment Processors

Under UAE law, Bitcoin must be converted into AED through licensed platforms such as Rain, Binance UAE, Hayvn, CryptoProcessing.com, or Coop Escrow. Using approved services ensures AML/KYC compliance and validates your contract with the DLD.

5. Complete Compliance Checks

Expect rigorous KYC/AML checks, including ID verification, proof of funds, and wallet screening. These requirements are mandatory for rentals and protect both tenant and landlord.

6. Execute Payment and Finalize Lease

Transfer Bitcoin through the licensed processor, which instantly converts it into AED. The landlord receives dirhams, and you sign your lease agreement (digital or paper). You’ll also receive an AED-denominated receipt indicating crypto as the original payment source.

7. Register Where Necessary

Long-term rentals often don’t require DLD registration, but short-term hospitality rentals may. Always keep AED payment documentation for potential visa or housing verification purposes.

Benefits of Paying Rent in Bitcoin

Faster Settlement

Unlike international bank transfers that may take days, Bitcoin transactions are confirmed within minutes. This is particularly useful for expatriates or global renters seeking efficiency.

Lower Transaction Costs

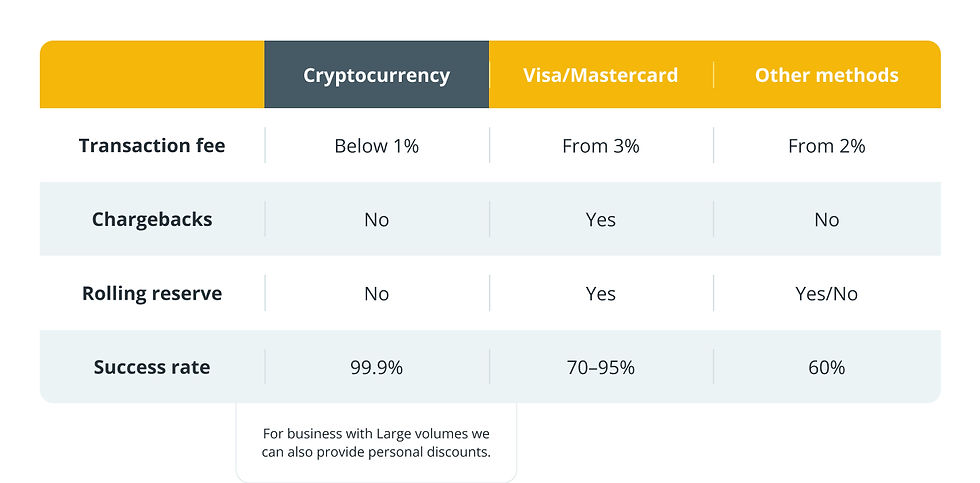

Crypto settlement fees are typically under 1%, compared to 2%–5% for cross-border transfers or FX fees. Over a year, this can save both tenants and landlords significant amounts.

Global Accessibility

Expatriates without UAE bank accounts can still transfer rent seamlessly from anywhere worldwide, bypassing currency conversion and banking obstacles.

Transparency and Auditability

Blockchain payments are timestamped and verifiable, creating an auditable trail for dispute resolution and regulatory compliance.

Risks of Renting with Bitcoin in Dubai

Volatility

Bitcoin’s price swings can affect rent if paid directly in BTC. Most leases therefore fix rent in AED, with either locked conversion rates or the use of stablecoins (USDT/USDC) to stabilize value.

Platform Risk and Unlicensed Providers

Always transact through VARA- or CBUAE-approved services like Rain, Binance UAE, or Hayvn. Unlicensed exchanges can expose you to fraud, fund loss, or even invalid rental contracts.

Limited Landlord Acceptance

Crypto rentals remain niche, with surveys showing only about 3% of landlords currently open to Bitcoin rent payments. Relying on specialized agencies may be necessary.

Regulatory Changes

As Dubai’s rules evolve, new requirements may arise. Starting August 2025, stricter AML/KYC measures for stablecoin and long-term rental payments are expected. Tenants must stay informed and prepared to adjust their leases accordingly.

Outlook for Bitcoin Rentals in Dubai, 2025 and Beyond

By mid-2025, paying Dubai rent with Bitcoin is practical but still a developing niche. Tenants succeed by partnering with established crypto-friendly developers like Emaar, Damac, Nakheel, or Engel & Völkers or working through agencies dedicated to crypto real estate.

Every valid lease should clearly specify AED rent, conversion methods, and dispute resolution terms. This helps protect both landlords and tenants from volatility or regulatory uncertainty.

The UAE’s Payment Token Services Regulation (PTSR), rolling out in 2025, will further strengthen oversight, making crypto-rentals more secure. Meanwhile, projects like Prypco Mint signal a future where tokenized real estate and Bitcoin-based housing become more mainstream.

Conclusion

Dubai is pioneering cryptocurrency adoption in real estate, offering a legally compliant and increasingly accessible pathway for tenants to pay rent with Bitcoin. While volatility, landlord acceptance, and evolving regulations remain challenges, robust licensing systems and AED conversion mandates provide a safety net.

For expatriates and digital asset investors, renting an apartment in Dubai with Bitcoin in 2025 is not only possible but also efficient, cost-effective, and aligned with the city’s vision of becoming a global crypto hub. Want to know which other cities allow you to pay rent with Bitcoin? Read our article.

Frequently Asked Questions

Can I pay my Dubai rent fully in Bitcoin?

No. Leases must be denominated in AED. Bitcoin payments are converted into dirhams through VARA-licensed providers before the landlord receives funds.

What is the typical rent price in Bitcoin?

As of 2025, monthly rents listed on crypto platforms like BaanCoin range between 0.007 BTC and 0.022 BTC, depending on property size and location.

Do all landlords in Dubai accept Bitcoin?

Not yet. Only around 3% of landlords are open to crypto payments, though this percentage is growing with the support of specialized agencies.

Is renting with Bitcoin cheaper than using banks?

Yes. Crypto settlement fees are usually under 1%, while international bank transfers and currency conversions can cost 2%–5%.

How do I protect myself from Bitcoin’s volatility?

Ensure your contract fixes rent in AED, with conversion rates locked or stablecoins (USDT/USDC) used to avoid sudden value changes.

Is it legal to rent in Dubai using Bitcoin?

Yes, as long as you use VARA-licensed or CBUAE-approved payment processors. This keeps the transaction valid under DLD rules.

Comments