Bitcoin Price Eyes $112K as Gold Reaches All-Time High

- Slava Jefremov

- Sep 3

- 3 min read

Introduction

Bitcoin and gold are once again moving in tandem, as both assets continue to capture investor attention amid shifting macroeconomic conditions. With gold striking fresh all-time highs above $3,500 per ounce and Bitcoin pushing toward $112,000, traders are weighing the possibility of further gains against the historical backdrop of September’s seasonal weakness. While bullish momentum has driven Bitcoin higher in recent sessions, uncertainty remains over whether the rally can sustain itself or if the cryptocurrency is destined for a corrective dip toward the $100,000 mark.

Key Takeaways

Bitcoin mirrors gold’s strength, climbing to nearly $112,000 while gold prints new record highs.

Risk of a $100,000 dip remains, with some traders cautioning against premature bullishness.

Historical September weakness suggests that mid-month losses are highly probable.

Bitcoin Surges Alongside Gold

At Tuesday’s Wall Street open, Bitcoin rallied sharply in step with gold, which broke into new record territory.

Data from Cointelegraph Markets Pro and TradingView revealed that BTC/USD reached fresh September highs of $111,775 on Bitstamp, marking a nearly 2% daily increase.

Gold simultaneously hit new all-time highs above $3,500 per ounce, extending momentum from a breakout that began following the release of U.S. macroeconomic data the previous Friday.

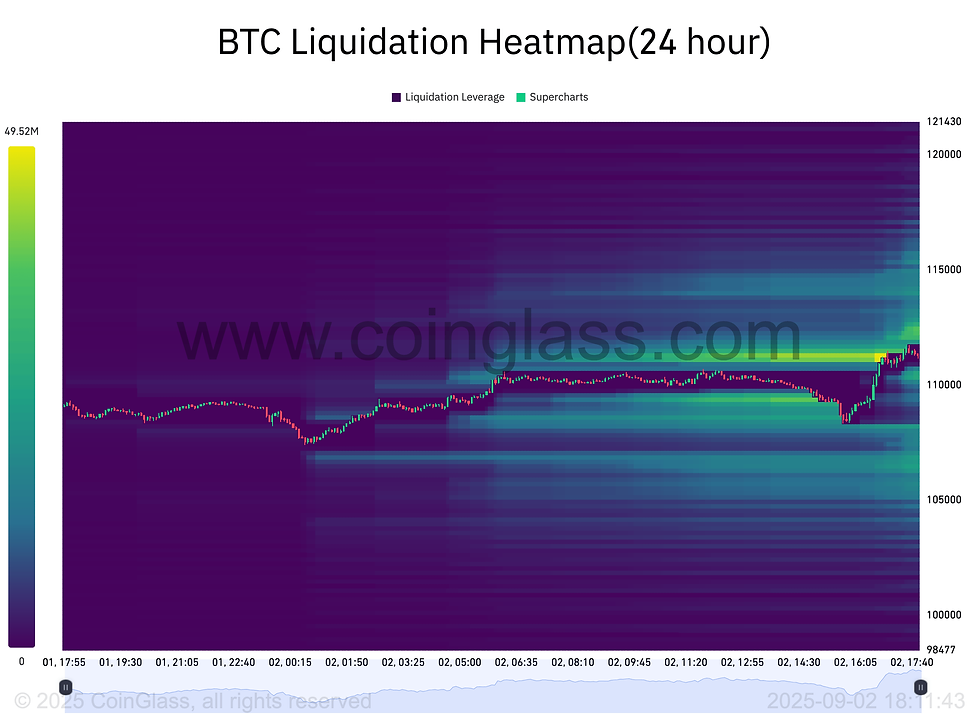

The move forced a wave of liquidations across the crypto market. According to CoinGlass, approximately $60 million worth of short positions were wiped out within a four-hour window, as Bitcoin’s surge caught bears off guard.

Analysts Weigh the Technical Picture

Despite the rally, analysts remain cautious about Bitcoin’s sustainability at these levels.

Keith Alan, co-founder of Material Indicators, highlighted the importance of the 21-day simple moving average (SMA) in determining Bitcoin’s next move.

“Strong technical resistance lives where the 100-Day SMA has confluence at the trend line,” Alan explained, warning that bulls need to secure a resistance-to-support (R/S) flip at that level to avoid a looming Death Cross between the 21-Day and 100-Day moving averages.

Echoing a cautious stance, Marcus Corvinus, a crypto market expert, referred to this period as a “critical moment” for Bitcoin’s price structure.

“Price has been riding an uptrend but now sitting at the bottom of the channel,” Corvinus wrote on X. “Heavy bearish candles closed, signaling buyers are losing grip. A breakdown here could confirm the end of the uptrend and the start of a fresh downtrend.”

However, not everyone agrees that a reversal is imminent. Popular trader Roman dismissed the notion of a completed reversal, noting instead that Bitcoin has lost $112,000 support and now risks flipping it into new resistance.

“No immediate signs of reversal here,” Roman summarized, adding that he still expects Bitcoin to retest the $100,000 support in the near term. He further reiterated his view that a decisive loss of the $100,000 threshold would end the current bull market cycle.

Historical September Weakness

Beyond technical analysis, market observers are also turning to Bitcoin’s historical performance for clues. Timothy Peterson, a network economist, reminded traders that September has consistently been a challenging month for Bitcoin.

Since 2013, Bitcoin has recorded average losses of 3.5% in September, making it one of the weakest months for the cryptocurrency.

“The monthly average is deceiving. Volatility is very high,” Peterson noted. “Between the 16th and the 23rd of September, Bitcoin dumps 100% of the time, with a typical decline of -5%.”

This seasonal trend adds another layer of caution to traders already wary of short-term overextension in Bitcoin’s recent price action.

Conclusion

As Bitcoin attempts to ride gold’s momentum toward $112,000, market sentiment is split between optimism and caution. While bulls cheer the rally and highlight macro tailwinds, skeptics point to technical resistance, weakening momentum, and September’s historical tendency for mid-month downturns. With analysts warning that a $100,000 dip remains firmly on the table, the next few trading sessions could prove decisive for Bitcoin’s medium-term trajectory.

Frequently Asked Questions

Why is Bitcoin moving in sync with gold right now?

Both Bitcoin and gold are viewed as alternative stores of value, and in times of macroeconomic uncertainty, they tend to rally together. Recent U.S. economic data has boosted both assets simultaneously.

What does a “Death Cross” mean for Bitcoin?

A Death Cross occurs when a shorter-term moving average (like the 21-day SMA) crosses below a longer-term moving average (like the 100-day SMA), often signaling potential bearish momentum.

Why is September considered a weak month for Bitcoin?

Historically, September has produced consistent losses for Bitcoin, with an average decline of 3.5% since 2013. Mid-September, in particular, has shown a 100% track record of downturns between the 16th and 23rd, making it a seasonally bearish period.

What price levels are traders watching right now?

Key levels include $112,000 (former support, now potential resistance) and $100,000 (major support zone). A sustained drop below $100,000 could mark the end of the current bull cycle.

Comments