AI Crypto Whale Tracking: How AI Detects Big Wallet Moves Before the Market Reacts

- Slava Jefremov

- Oct 9

- 5 min read

Key Takeaways

AI can instantly process massive on-chain datasets, identifying transactions that exceed predefined thresholds.

Connecting to a blockchain API enables real-time tracking of high-value transfers and creates a personalized whale activity feed.

Machine learning clustering algorithms can group wallets by behavior, revealing accumulation, distribution, or exchange trends.

A phased AI strategy, evolving from monitoring to automated trading execution, helps traders act before broader market reactions occur.

Introduction

The ability to anticipate major market movements has always been a dream for traders. In cryptocurrency markets, where large holders (known as crypto whales) can dramatically influence price action, detecting their movements early can turn volatility into opportunity.

In August 2025, a Bitcoin whale sold 24,000 BTC, valued at nearly $2.7 billion, triggering a rapid market decline that wiped out over $500 million in leveraged positions within minutes. Traders with early insight into that activity could have adjusted exposure, hedged positions, or strategically entered during the sell-off instead of reacting to it.

Today, artificial intelligence (AI) offers the capability to analyze vast amounts of on-chain data, automatically detect anomalies, and identify whale patterns that may signal upcoming market moves. This article explores how AI crypto whale tracking plays a crucial role in spotting whale wallet activity and translating it into actionable insights.

On-Chain Data Analysis of Crypto Whales with AI

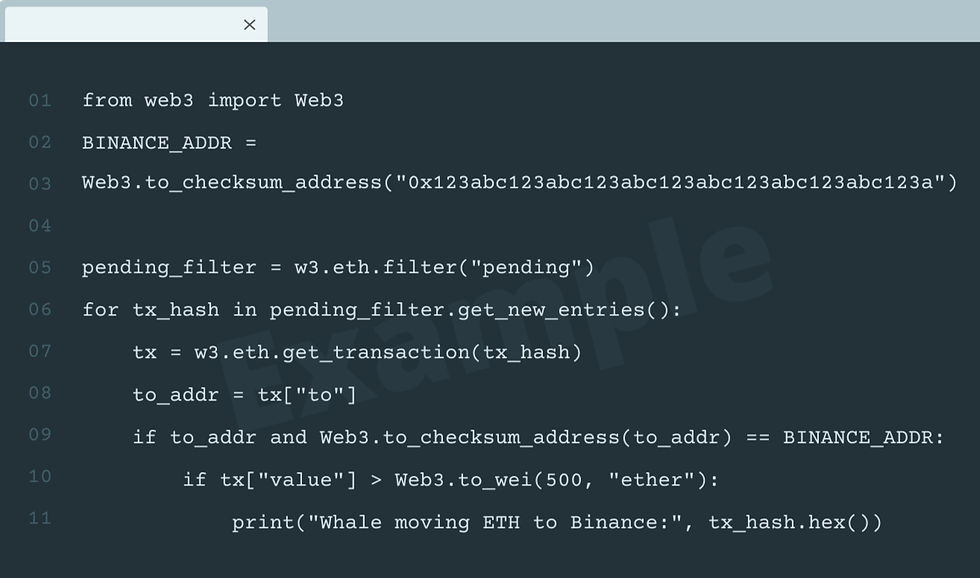

One of the most direct applications of AI in whale tracking is transaction filtering. By training an AI model to detect transfers above a certain threshold, traders can automatically flag whale-level transactions for review.

For example, consider a transfer exceeding $1 million in Ether (ETH $4,344). Such activity can be monitored using a blockchain API, which streams real-time transaction data. By embedding rule-based logic, the AI system can scan these transactions continuously and highlight those that match predefined conditions.

The outcome is a customized whale transaction feed—a real-time source that identifies and categorizes high-value wallet movements before they influence broader market sentiment.

How to Connect and Filter with a Blockchain API

Step 1: Sign up with a blockchain API provider such as Alchemy, Infura, or QuickNode.Step 2: Generate an API key and configure your AI model to retrieve live transaction data.Step 3: Apply query filters for attributes like transaction value, token type, or wallet address.Step 4: Implement a listener function that continuously scans new blocks and triggers alerts when rules are met.Step 5: Store flagged transactions in a database or dashboard for further AI-based analysis.

This process transforms market visibility. Instead of reacting to price movements, traders can observe the underlying transactions driving those changes, gaining insight before most of the market catches on.

Behavioral Analysis of Crypto Whales with AI

Whales rarely make their moves obvious. Large holders often split assets across multiple wallets, execute transfers over time, or route funds through exchanges strategically. Understanding these behaviors requires advanced AI techniques, including clustering and graph analysis.

Graph Analysis for Connection Mapping

In graph analysis, each wallet functions as a node, and each transaction represents a link. By mapping these relationships, AI models can uncover networks of wallets potentially controlled by a single entity.

For instance, if several wallets consistently send assets to the same group of smaller accounts, the algorithm can infer they may belong to the same whale. This level of connection mapping provides traders with a deeper structural view of whale operations.

Clustering for Behavioral Grouping

Once connections are mapped, clustering algorithms such as K-Means or DBSCAN can categorize wallets by their behavioral patterns. These groups may reflect strategies like gradual accumulation, distribution, or exchange inflows.

The model doesn’t inherently know what a whale is—it learns patterns statistically, identifying behaviors historically associated with major holders.

Pattern Labeling and Signal Generation

After clustering, analysts (or a secondary AI model) can label wallet groups as “long-term accumulators,” “exchange distributors,” or other behavior types.

This structured classification converts raw blockchain data into actionable intelligence. Rather than simply tracking transaction size, the AI system interprets the intent behind whale movements, revealing strategies and trends invisible to basic analytics.

Advanced Metrics and the On-Chain Signal Stack

To predict market movements more precisely, traders can expand AI tracking beyond simple transaction volume to include on-chain performance metrics.

Key indicators such as the Spent Output Profit Ratio (SOPR) and Net Unrealized Profit/Loss (NUPL) help measure market sentiment and profitability. Significant shifts in these metrics often precede trend reversals.

Exchange flow data, including inflows, outflows, and the whale exchange ratio, further reveal whether large holders are preparing to sell or accumulate for long-term positions.

By integrating these variables into a comprehensive on-chain signal stack, AI moves from mere detection to predictive modeling. Instead of responding to a single whale movement, the system analyzes a convergence of signals that collectively indicate major shifts in market positioning.

This multi-layered approach provides traders with early and high-confidence insights into potential market transitions.

Step-by-Step Guide to Deploying AI-Powered Whale Tracking

Step 1: Data Collection and Aggregation

Connect to blockchain APIs such as Dune, Nansen, Glassnode, or CryptoQuant to access both historical and real-time data. Apply filters to isolate large-scale transfers that signify whale-level activity.

Step 2: Model Training and Pattern Identification

Clean and process the collected data to train machine learning models. Use classifiers to tag known whale wallets and clustering algorithms to identify networks and hidden accumulation patterns.

Step 3: Sentiment Integration

Combine quantitative data with AI-based sentiment analysis sourced from social platforms like X, crypto forums, and news feeds. Correlate whale activity with shifts in social sentiment to contextualize behavioral changes.

Step 4: Alerts and Automated Execution

Set up real-time notifications via Discord, Telegram, or similar platforms. Advanced users can integrate automated trading bots to execute trades immediately when whale-related signals trigger.

From simple monitoring to fully automated execution, this phased methodology gives traders a systematic advantage, enabling proactive positioning before market-wide reactions occur.

Conclusion

AI has become an indispensable ally for traders seeking to interpret the complex and often concealed behavior of crypto whales. By merging real-time on-chain data, behavioral clustering, and predictive modeling, traders can transform what was once chaotic market noise into actionable insight.

As blockchain data becomes more transparent and AI models continue to evolve, early detection of whale activity will no longer be the domain of institutions alone. Individual traders equipped with the right tools and structured AI workflows can now compete on a level playing field, anticipating market shifts before they happen.

Frequently Asked Questions

What is a crypto whale?

A crypto whale refers to an individual or entity holding an exceptionally large amount of cryptocurrency. Their transactions can significantly influence market prices and liquidity.

How can AI detect whale movements?

AI analyzes real-time blockchain data to identify high-value transfers, clusters related wallets, and recognize recurring behavioral patterns associated with accumulation or distribution.

Which APIs are best for whale tracking?

Leading providers such as Alchemy, Infura, QuickNode, Nansen, and Glassnode offer comprehensive blockchain data feeds suitable for integration into AI models.

Can AI predict market crashes caused by whales?

While AI cannot guarantee perfect prediction, combining on-chain analytics with sentiment analysis improves the probability of detecting early warning signals of large-scale movements.

Is whale tracking suitable for beginners?

Yes. Even without advanced coding knowledge, traders can use simplified dashboards and data aggregators to visualize whale activity and complement their technical analysis strategies.

Comments